In this article, you will get to know all about GST Number Search by PAN.

GST (Goods and Service Tax) is an indirect tax that people pay at every stage when buying and selling goods or using services in India. All registered taxpayers under GST must have a GST Identification Number (GSTIN) and every one of them is given this number. This is a 15-digit alphanumeric code which is a pre-requisite for making all transactions that are GST-related.

At times, you might have to look for GST numbers using PAN (Permanent Account Number). The business or an individual is who you need to search. PAN stands for permanent account number and it is a unique code assigned by the Income Tax Department of India having ten characters, comprising of numbers and the alphabet.

GST Number Search by PAN

Here’s how you can search for a GST number using PAN

Method 1

Through the GST Portal users will get a chance to file their GST returns which will help in hassle-free filing of GST returns that will contribute towards the improvement of efficiency.

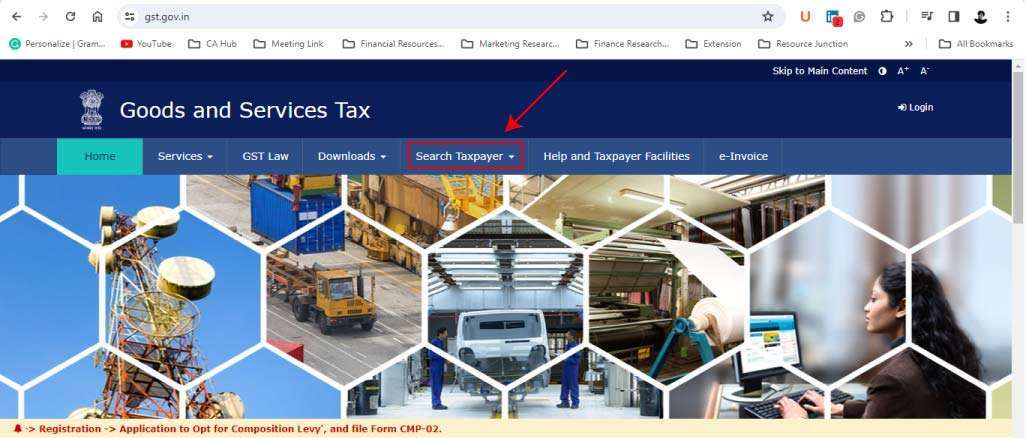

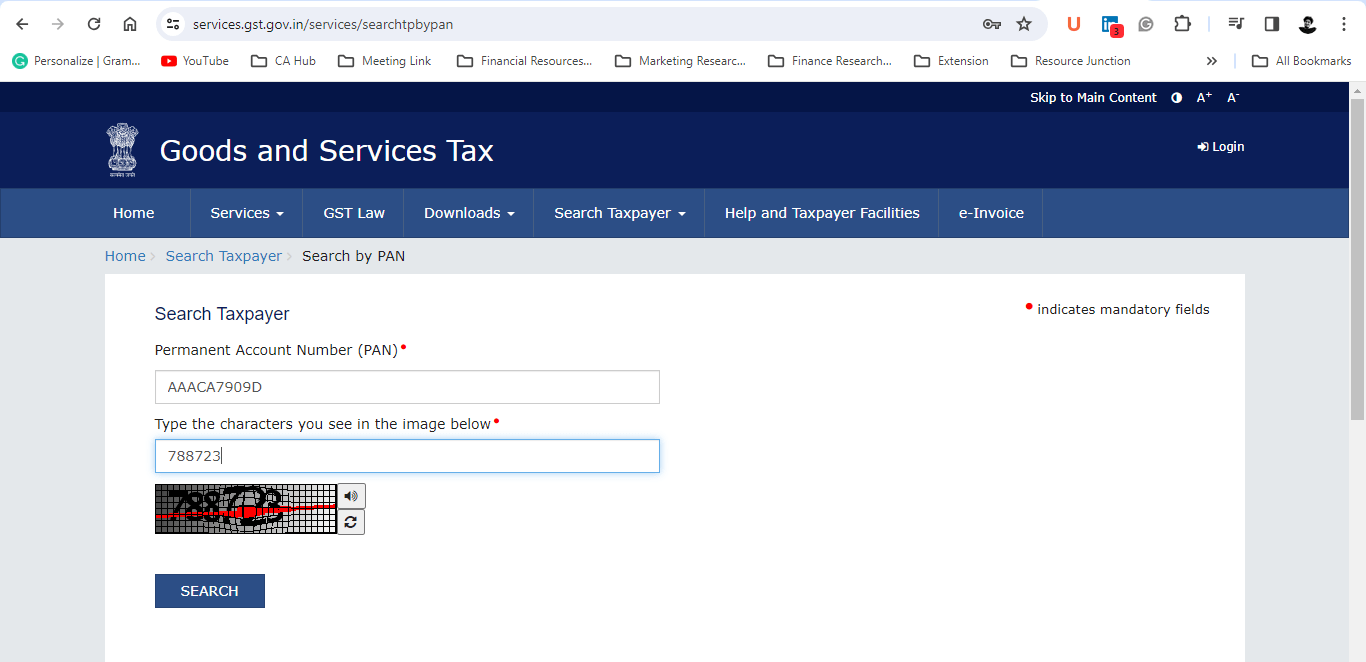

Step 1 – Visit the GST Portal- Go to the official GST Portal https://gst.gov.in/

Step 2 – Navigate to the ‘Search Taxpayer’ Section

Step 3 – On the GST Portal homepage, use the Link ‘Search Taxpayer’ to help you look at the taxpayer. Click on it.

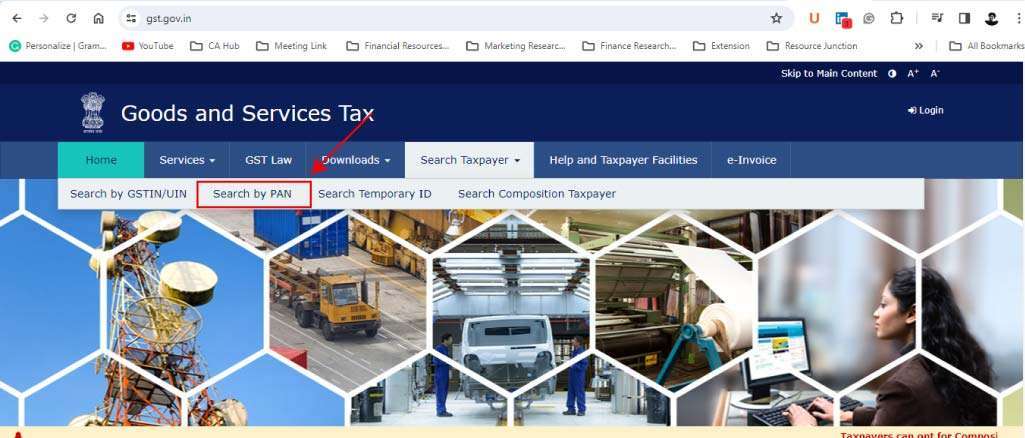

Step 4 – Choose Search by PAN, Here, you’ll witness an assortment of options for finding taxpayers. The ‘Search’ option becomes available at ‘Search by PAN’.

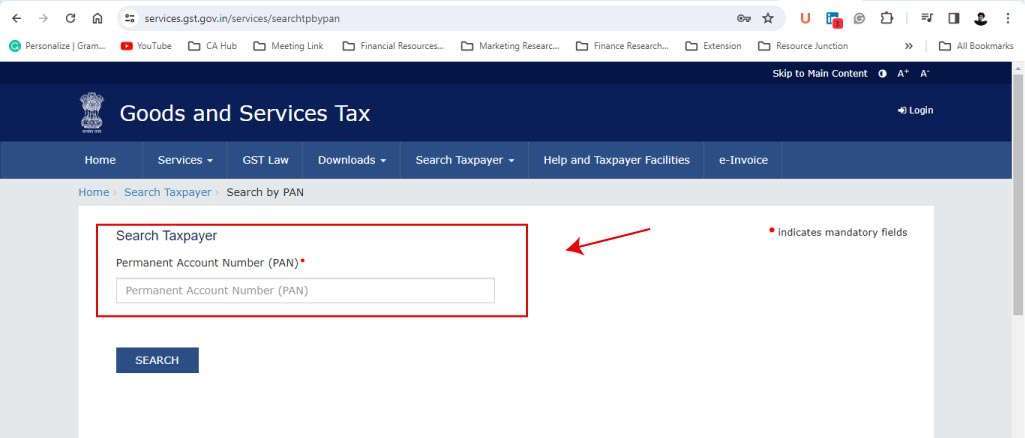

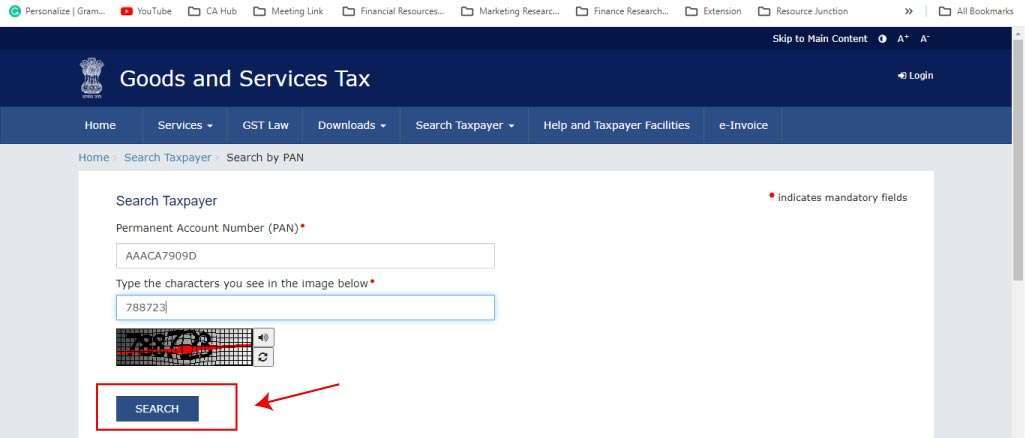

Step 5 – Enter PAN Details, Put the PAN of the taxpayer whom you want to look for, and press the ENTER button.

Step 6 – Click Search, Once the PAN is completed, click on “Search.”

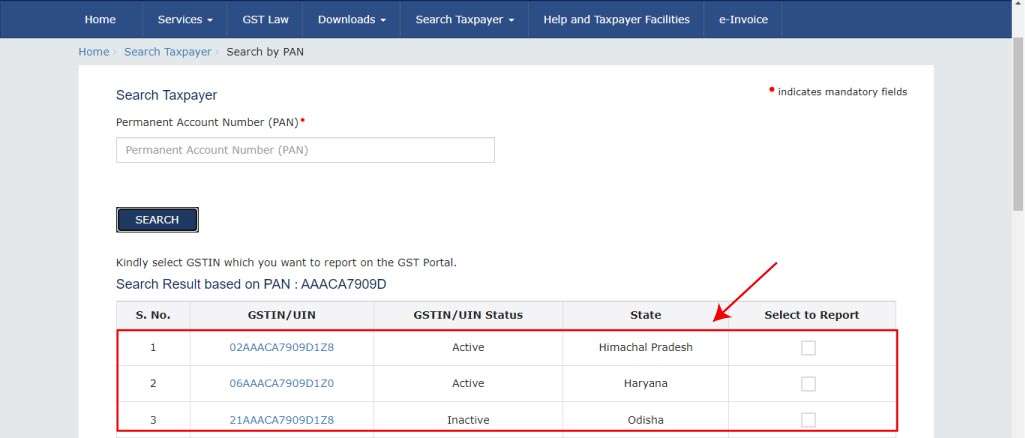

Step 7 –View Results, The page will show the GSTN associated with the specified PAN and the other taxpayer details.

Method 2

Third-party websites are infiltrating online commercialization by displaying their products and services on websites that they have nothing to do with.

Along with that, there are more than one website and tools powered by a third party that give you the facility to search GST numbers by inputting the PAN. Here are the steps for using some of these websites.

Here are the steps for using some of these websites-

Step 1 – Go to a Trusted Third-Party Website, Some websites provide free GST search services which can be used by anyone. Be sure to use sites of trustworthy and reliable nature.

Step 2 – Enter PAN Details, On the website search bar, put the PAN associated with which you intend to find the GSTIN there.

Step 3 – Initiate Search, Click the “Search” or “Find GST.” button.

Step 4 – View Results, The web portal will feature in this, along with additional salient information.

Things to Remember

Technically, GST numbers are supposed to be official generally and their details are easily found on reliable third-party websites.

GSTIN can be considered as confidential information, caution must be exercised once it is passed on to you and be used only for legit reasons.

GST Number Search by PAN – FAQ

Why would I need to search for a GST number using PAN?

Searching for a GST number using PAN helps in verifying the authenticity of a business entity. It ensures transparency in transactions and compliance with GST regulations.

Is it safe to use third-party websites for GST number searches?

While many third-party sites offer this service, it’s important to use reputable and trusted platforms to ensure data security and accuracy.

What information will I get from the GST number search using PAN?

You’ll receive the GST Identification Number (GSTIN) associated with the provided PAN, along with other relevant taxpayer details.

Can I verify the obtained GSTIN information from other sources?

Yes, it’s advisable to cross-verify the GSTIN details obtained through searches with official documents or sources for accuracy.

Are there any charges for searching GST numbers using PAN?

Searching for GST numbers using PAN is typically free on the official GST portal. However, third-party websites may have their own policies regarding fees.

What if I don’t have the PAN of the business or individual?

If you don’t have the PAN, you may not be able to perform a direct search. In such cases, consider other methods of verifying the GSTIN, such as checking invoices or contacting the business directly.

Can I search for multiple GST numbers using PAN?

Yes, you can search for multiple GST numbers by entering the respective PANs one by one on the GST portal or third-party websites.

Is the GST number search using PAN legal?

Yes, it is legal and intended for verification purposes to ensure compliance with GST regulations and transparency in transactions.

Bottomline:-

It is vital to confirm the information obtained from these particular sources by utilizing official documents or information as many times as possible.

To recall, the GST number PAN lookup facility is primarily a necessity for verification and seeing through financial accounting that is transparent. GSTN would facilitate creating a database of GSTIN with PAN which is going to help in authentication of the same.

Also Read