Introduction

A dynamic branch of economics is called public finance which analyses ways by which governments may raise money, distribute budgets, and manage financial activities to satisfy common demands. This area is concerned with taxes, state budget, and debts as regards state financial activities concerning the welfare of society. Public finance deals with pursuing economic stability, equal share of wealth, and strategic planning to improve lives in cities. To understand this relationship that exists between government policy or public finance and the economy we have to look into the Nature of Public Finance.

What is the Nature of Public Finance?

Public finance has a complex nature since it involves interdependency between state economics and public welfare. Here are key aspects.

| Revenue Generation | Resource Allocation | Economic Stability |

| Debt Management | Provision of Public Goods | Equitable Resource Distribution |

| Political Influence | Social Welfare | Strategic Financial Planning |

Revenue Generation: The concept of public finance includes the generation of income flows or revenues essentially from taxes. These comprise direct taxes on income and wealth, indirect taxes levied on goods and services, and other sources of revenue including fees and fines.

Resource Allocation: Public finance provides governments with the means of ensuring an equitable and efficient use of resources. Such an approach implies proper allocation for investments in public goods and services including infrastructure, health sector, and social protection programmes.

Economic Stability: The stability of an economy depends greatly on public finances. Governments use fiscal mechanisms in an attempt to curb inflation, check deficits, and bring their budget under balance thus helping in achieving macroeconomic equilibrium.

Debt Management: Borrowing is very common in governments’ finances. Such public finance strategies involve good debt and borrowing management to guarantee economic viability, low excess debt loads, and responsible budgeting and borrowing.

Equitable Resource Distribution: The second important consideration is fairness in sharing resources. Public finance uses taxation and targeted spending to address inequality, promote social justice, and foster the economic welfare of everyone.

Provision of Public Goods: On the other hand, in public finance, public goods are intended to be financed including public infrastructure, law enforcement, and national defense for societal benefit.

Strategic Financial Planning: Long-term financial planning is meant to provide for social requirements and other economic growth aspirations on behalf of public finance. Effective resource management calls for forecasting and adjustment to the fluctuating economic situation.

Social Welfare: Social welfare is the inherent feature of public finance. # Governments spend through public expenditures in an attempt to serve as a safety net, supporting vulnerable individuals and improving citizen’s standards of living.

Political Influence: Political considerations influence public finance decisions as they showcase the concerns and preferences that a ruling regime embraces. Political dynamics usually dictate how resources are allocated and the formulation of fiscal policies.

Transparency and Accountability: Public finance is based on principles of openness and responsibility. As such, governments ought to communicate transparently about revenues, expenses, disbursements, budgets, and expenditure reports that may be comprehended by the people.

Therefore, by considering the characteristics of public finance in economic, and sociological aspects as well as politics, it can be concluded that public finance is constantly changing and versatile. Governments use it as one important instrument for ensuring the economic stability of society and meeting all requirements of the residents of the country.

Significance of Public Finance

Public finance is important because it helps governments to support their economic, social, and political systems for development. Key aspects of its significance include.

Societal Well-being- Funds for public finance support necessary public services in education, health care, and infrastructure making an environment good for citizens’ living.

Economic Stability- Public finance assists in stabilizing the economy by curbing inflation through strategic fiscal policies that control budgetary deficits and support long-term sustainable growth.

Resource Allocation- This empowers a government to use scarce resources in a prudent manner making sure that such funds will be channelled appropriately on those priority areas where they are most needed for sustainable development purposes among others.

Social Justice- Progressive taxation as well as targeted welfare spending aimed at helping vulnerable groups in society is the main strategy used by Public Finance to address the issue of unequal distribution of incomes and promote social fairness.

Infrastructure Development- Public finance is a tool governments use in funding vital infrastructural projects to enhance a country’s competitive edge with its counterparts.

National Defense- It includes the budget for national defense that defends the country’s sovereignty as well as secures its people.

Global Competitiveness– Public finance well managed translates into international competitiveness; it promotes conducive business surroundings, draws investors, and leads to increased economic activity within the nation.

Crisis Management- Governments need fiscal strength to mitigate against sudden unexpected occurrences and emergencies so that they can develop efficient remedial measures.

Environmental Sustainability- Public finances are crucial in ensuring sustainable development by taking environmental considerations into account and thus conserving nature’s endowment.

Political Decision-Making- Political choices are mirrored in public financial management leading to policy agenda setting as well as governance. Governments use it to translate politics into operational monetary decisions.

Citizen Confidence- Honest and open public finance strengthens trust in state organizations. The public has to ensure that trust is earned for citizens to perceive that public money is spent appropriately thereby increasing their chances of supporting such policies and programs.

Long-term Planning- The public finances include medium to long-term financial plans that enable the government to deal with prospective problems, effect necessary investments, and keep fiscal stability in the state.

Essentially, public finance is central as it drives economic, social, and political growth, promoting fairness and sustainable change within a country.

How Does Public Finance Impact the Overall Economy?

Public finance significantly impacts the overall economy through various mechanisms that influence economic stability, resource allocation, and societal well-being. Here are key ways in which public finance shapes the economy:

- Economic Stability: Public finance policies, including fiscal and monetary measures, play a crucial role in maintaining economic stability. Through prudent management of taxation, government spending, and debt, public finance contributes to controlling inflation, managing deficits, and promoting a balanced economic environment.

- Investment in Infrastructure: Public finance enables projects such as road construction, bridge building, and provision of utilities. Such investments fuel economic activity, provide jobs and improve productivity that eventually leads to sustained economic growth.

- Resource Allocation: By determining budgetary priorities, public finance influences the allocation of resources to different sectors. Strategic resource allocation ensures that funds are directed toward areas that maximize economic and societal benefits.

- Social Welfare Programs: Public finance supports social welfare initiatives, providing a safety net for vulnerable populations. This fosters social stability and enhances human capital, positively impacting overall economic productivity.

- Taxation Policies: Taxation is a key tool in public finance. Progressive taxation and targeted tax incentives influence income distribution, consumer behavior, and investment decisions, shaping economic dynamics.

- Government Expenditure: Public finance determines the scale and nature of government expenditures. Well-planned spending on education, healthcare, and research and development contributes to human capital development and technological advancement, driving economic progress.

- Debt Management: Prudent management of public debt is essential for economic health. Public finance decisions related to borrowing impact interest rates, government creditworthiness, and overall fiscal sustainability.

- Crisis Management: In times of economic crises, public finance provides governments with the tools to implement stimulus packages, monetary interventions, and other measures to mitigate the impact of economic downturns and support recovery.

- Environmental Sustainability: Public finance policies can incentivize environmentally sustainable practices. Funding for green initiatives, regulation of carbon emissions, and other measures contribute to sustainable economic development.

- Global Competitiveness: A well-managed public finance system enhances a nation’s global competitiveness. It attracts investments, fosters innovation, and creates a stable economic environment that encourages business growth.

- Citizen Confidence: Transparent and responsible public finance practices build confidence among citizens, businesses, and investors. Confidence in the government’s financial management positively influences economic activities and investment decisions.

Public finance therefore is an important tool for influencing other economic affairs. Through prudent fiscal policies, sound administration of natural resources, and wise investment, public finance is key to promoting sustainable economic development and social welfare.

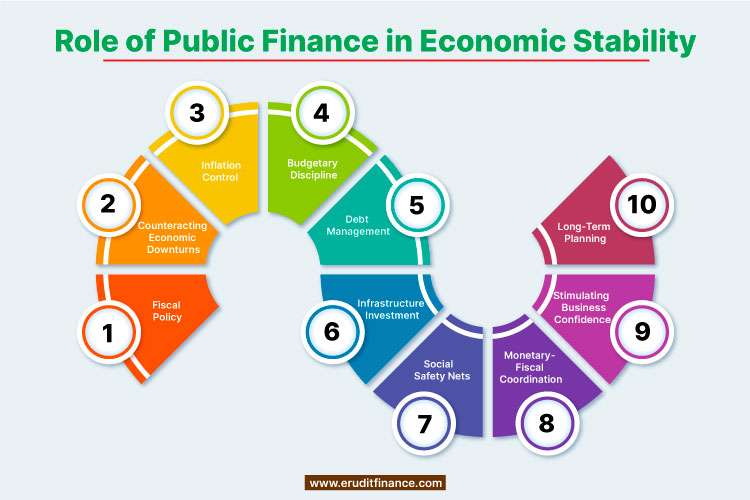

What is the Role of Public Finance in Economic Stability?

Public finance plays a crucial role in ensuring and enhancing economic stability through various mechanisms

1). Fiscal Policy- Economic stabilization tools include public finance especially, fiscal policy. Fiscal means adjusting tax rates and government expenditures to dampen or moderate the economic cycle and maintain stable aggregate demand.

2). Counteracting Economic Downturns- Public finance is what allows governments to implement expansionary economic strategies in times of economic downturns and recessions. It entails increasing national government expenditure, lowering taxation, or combining the two measures to increase national output and aggregate demand.

3). Inflation Control- Inflation is controlled in public finance using contractions monetary policy during a period of high inflation. Such action might take place by cutting down on government expenditures while at the same time increasing taxes to cool down the overheated nation’s economy.

4). Budgetary Discipline- It is an important element of public finances to have a balanced budget across the economic cycle. Fiscal discipline means that public spending should correspond to revenues, avoiding large budget deficits and general macroeconomic stability.

5). Debt Management- Government debt is the key element of public finance policies that are aimed at ensuring a sustainable fiscal regime. Sensible debt control approaches such as responsible borrowing and prompt debt repayment contribute greatly to economic stability since they prevent the accumulation of unreasonable debt amounts.

6). Infrastructure Investment- Infrastructure project that enhances economic stability is supported by public finance. It doesn’t just create work opportunities but it also develops general efficiency as far as the economy is concerned”:

7). Social Safety Nets- Public financing is necessary to implement social safety nets including employment benefits and the welfare system. These play an important role in stabilizing society especially when there are economic challenges.

8). Monetary-Fiscal Coordination- Monetary policy and public finance coordinate their efforts toward realizing economic stability. Coordination of fiscal and monetary policies helps to tackle inflationary pressure in an integrated manner alongside addressing unemployment and promoting general economic development.

9). Stimulating Consumer and Business Confidence- Consumers, businessmen, and investors gain confidence in public finance if sound public finance policies are observed and indicate honesty in financial affairs. Hence, confidence is an essential aspect of maintaining economic transactions.

10). Long-Term Planning- Long-term public finance includes consideration of the changes in demography as well as new technologies that affect the stability of the economy. Governments use strategic planning to predict possible future challenges and come up with actions that foster peace.

Lastly, public finance is the stabilizer of the economy as it gives the government the needed tools to combat economic changes, fight inflation, and practice appropriate budgeting. Public finance is a critical component in developing an environment, for sustainable growth and prosperity.

Bottomline:

The nature of public finance is dynamic, encompassing the study and management of government finances. It involves revenue generation, efficient resource allocation, and strategic financial planning to meet societal needs. Public finance influences economic stability, fosters equitable distribution, and addresses diverse objectives, from infrastructure development to social welfare. It has a multi-dimensional character that explains the interconnection between expenditures state-generated and people’s prosperity, hence playing an all-important role in determining the economic, sociocultural, and political image of the state. It is vital to comprehend the intricacies of appropriate leadership and sustainable growth.

Also Read: