Introduction Corporate Finance Institute Free Courses

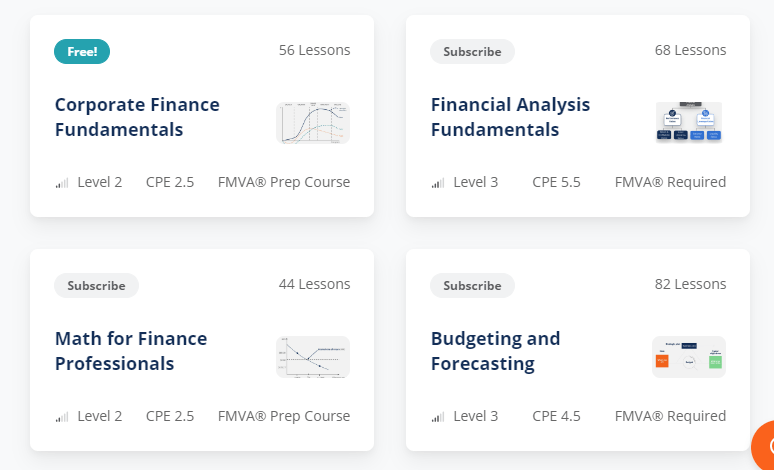

Corporate Finance Institute (CFI) offers an array of free courses providing invaluable insights into financial management. Covering key topics such as financial modeling, valuation, Excel skills, and more, these courses cater to professionals and students seeking to enhance their financial expertise. CFI’s commitment to accessible education makes these courses a valuable resource for anyone looking to advance their corporate finance knowledge. With practical, industry-relevant content and a user-friendly platform, Corporate Finance Institute Free Courses empower learners to excel in the dynamic field of corporate finance, making quality financial education accessible to a global audience.

Can I Get CFI Courses for Free?

Yes Right, CFI offers free courses as part of its mission to provide financial education for all. Essential topics in corporate finance, financial modeling, and valuation as well as Excel skills are covered by these courses.

CFI’s goal is to provide these resources free of charge so that financially literate people can be spread across the entire world. Whether you’re a professional looking to strengthen your knowledge or an amateur eager for insights, CFI’s platform offers many free courses on corporate finance.

How Can I Study Finance for Free?

Studying finance for free is possible through various online platforms and resources. Here’s a guide on how to do it:

| Online Courses | Many reputable platforms offer free finance courses. Check websites like Coursera, edX, and Khan Academy for courses ranging from basic financial concepts to advanced topics like financial modeling. |

| YouTube Channels | Explore finance-related YouTube channels that provide tutorials, lectures, and discussions on finance topics. Channels such as Khan Academy, YaleCourses, and The Plain Bagel offer valuable content for free. |

| OpenCourseWare (OCW) | Universities like MIT and Yale offer free access to their course materials through OCW. You can find finance-related courses, lecture notes, and assignments to study at your own pace. |

| Public Libraries | Local libraries often have a wealth of finance-related books and resources. Take advantage of these resources to learn about personal finance, investing, and financial planning. |

| Financial News Websites | Stay updated on financial news by following reputable websites like Bloomberg, Investopedia, and The Wall Street Journal. These platforms offer articles, tutorials, and insights into various financial topics. |

| Podcasts | Listen to finance podcasts to gain insights from experts in the field. Podcasts like “Planet Money,” “The Dave Ramsey Show,” and “InvestED” cover a wide range of financial topics. |

| Professional Associations | Explore websites of finance professional associations like the CFA Institute or ACCA. They often provide free resources, webinars, and articles to help you stay informed. |

| Online Forums and Communities | Join finance-related forums and communities such as Reddit’s r/finance or LinkedIn groups. Engaging in discussions with professionals and enthusiasts can provide valuable perspectives and insights. |

Remember to verify the credibility of the sources you use and supplement your learning with practical applications, such as managing your finances or participating in online financial simulations. With dedication and a strategic approach, you can build a solid foundation in finance without spending a fortune.

Which Certification Is Best for Corporate Finance?

In the field of corporate finance, several certifications are highly regarded. The right certification depends on your career goals, industry focus, and the specific skills you are targeting. Here are some notable certifications for corporate finance:

Chartered Financial Analyst (CFA):

CFA is a designation offered by a global organization called the CFA Institute. A wide variety of financial topics, such as ethics, investment instruments, and portfolio management. Suitable for professionals seeking a career in investment management, equity research, and asset management.

Certified Corporate Financial Planning & Analysis Professional (FP&A):

Presented by the Association for Financial Professionals (AFP). The big business focuses on corporate financial planning, budgeting, forecasting, and analysis. Suitable for financial planning and analysis professionals.

Certified Public Accountant (CPA):

Award given by the American Institute of CPAs (AICPA). Although traditionally related to accounting, CPAs typically fill major finance positions in companies and are especially important for financial reporting and compliance work. For people interested in finance roles with a focus on accounting.

Financial Risk Manager (FRM):

Sponsored by the Global Association of Risk Professionals (GARP). Focuses on risk management–market, credit, and operation risks. A must for those planning on a career in corporate or financial institution risk management.

Certified Treasury Professional (CTP):

Administered by the Association for Financial Professionals (AFP). Treasury and cash management–liquidity management, capital markets. For professionals engaged in treasury work within companies.

Chartered Institute of Management Accountants (CIMA):

CIMA, a global professional association. To choose the right certification, think about your career objectives and pinpoint specific skills you like to develop; also consider which industry it is suited for.

In the corporate finance field, many professionals hold multiple certifications to round out their skills and make themselves more attractive in the market.

What Is the Easiest Course in Finance?

Determining the “easiest” course in finance can be subjective and depends on your background, interests, and existing knowledge. However, some introductory courses are generally considered accessible for beginners:

| Personal Finance Courses: | Courses that cover personal finance basics are often straightforward and practical. Platforms like Coursera, Khan Academy, or local community colleges may offer such courses. |

| Introduction to Finance: | Many universities and online platforms offer introductory finance courses that cover fundamental concepts without delving into complex financial models. These courses are designed for beginners. |

| Financial Literacy Workshops: | Local community centers, libraries, or financial institutions may offer workshops on financial literacy. These workshops are aimed at providing basic financial knowledge. |

| Online Finance Basics Tutorials: | Websites like Investopedia offer free tutorials covering basic financial concepts. These resources are designed and made to be informative and accessible. |

| Foundations of Investing: | Introductory courses on investing, available on platforms like Udemy or LinkedIn Learning, can provide a gentle introduction to investment principles without delving into advanced topics. |

When choosing a course, consider your current knowledge level, learning preferences, and the specific area of finance you are interested in. While these courses are considered relatively accessible, it’s important to invest time and effort to grasp the concepts thoroughly. Finance, like any field, becomes easier with a solid foundation and continued practice.

What Is the Hardest Course in Finance?

For a given individual, the difficulty of taking a finance course can change according to factors such as their background and experience in that particular field. However, some finance courses are viewed as tough because of their intricate concepts and in-depth coverage. Here are a few examples:

a). Advanced Financial Modeling: More obscure courses, such as those that employ complex Excel models or scenario analysis of revenue modeling techniques can be daunting. These are courses offered in advanced finance or Master of Business Administration (MBA) programs.

b). Derivatives and Risk Management: Because such courses cover derivatives, options pricing, and risk management. The material is mathematical at many levels. To grasp the concepts of Black-Scholes modeling and how to handle financial derivatives, one needs a firm background in finance as well as mathematics.

c). Quantitative Finance: Advanced mathematical modeling and statistical analysis are involved in the quantitative finance courses. They are usually found in special programs and rely on strong math, programming, and financial theory.

d). Advanced Investment Strategies: Such courses as sophisticated investment strategies, alternative investments, and hedge fund strategies can be difficult. This usually involves a very good grasp of financial markets, economic principles, and risk management.

e). Corporate Finance Theory: It is often hard to follow advanced corporate finance theory courses at the graduate level. These examine financial concepts in depth, strategic decision-making, and complex financial structures from all angles possible.

Of course, what is hard depends on the person. What’s difficult for one may not be a problem at all for another Students should select courses according to their own interests and career plans, as well as their current level of knowledge. If they seek additional resources or support, then so be it. Courses taught by engaging, experienced instructors also have a major effect on the learning experience.

How Do I Start a Career in Corporate Finance?

Complete the step-by-step guide below to help you begin a career in corporate finance:

Educational Foundation: Obtain a relevant degree: You’ll generally need a bachelor’s degree in finance, accounting, or economics. For career advancement, think about pursuing an MBA or specialized master’s.

Build Financial Skills: Develop quantitative skills: Deepen your knowledge of financial concepts, accounting principles, and quantitative analysis. The ability to use Excel is important for financial modeling and analysis.

Internships and Entry-Level Positions: Seek internships: Through internships in corporate finance or related fields obtain practical experience. A hands-on experience is beneficial for one’s resume and understanding the daily workings of a finance job.

Networking: Attend networking events: Network with professionals in the finance business at networking events, conferences, and industry get-togethers. Network with alumni, members of the profession, and colleagues on platforms like LinkedIn.

Certifications: Consider relevant certifications: Enhance your credentials by achieving certifications such as the Chartered Financial Analyst (CFA), Certified Public Accountant (CPA), or Certified Corporate Financial Planning and Analysis Professional.

Develop Soft Skills: Hone communication skills: Effective communication is crucial in corporate finance. Develop your ability to articulate financial information clearly and concisely to various stakeholders.

Build Analytical Skills: Enhance analytical skills: Develop strong analytical skills to interpret financial data, perform financial modeling, and make data-driven decisions.

Stay Informed: Stay updated on industry trends: Follow financial news, read industry publications, and stay informed about market trends to demonstrate your interest and knowledge in the field.

Apply for Entry-Level Roles: Apply for entry-level positions: Look for roles such as financial analyst, junior accountant, or finance assistant to start your career. These positions provide foundational experience in corporate finance.

Continue Education and Professional Development: Pursue continuous learning: The finance field is dynamic, so staying updated on industry trends and continuing your education through workshops, online courses, or advanced degrees is crucial for career growth.

Seek Mentorship: Find a mentor: Identify experienced professionals in corporate finance who can provide guidance, advice, and insights into the industry. Mentorship can be invaluable for career development.

By combining education, practical experience, networking, and ongoing skill development, you can position yourself for a successful career in corporate finance. Tailor your approach based on your interests within corporate finance, whether it’s financial analysis, treasury management, or strategic financial planning.

Bottomline:-

Corporate Finance Institute (CFI) offers a range of free courses, providing accessible and comprehensive financial education. These courses cover key areas such as financial modeling, valuation, Excel skills, and more. With user-friendly platforms and real-world applications, CFI’s free courses empower learners globally to enhance their corporate finance knowledge. Whether you are a professional looking to upskill or a student seeking foundational insights, CFI’s commitment to free, quality education makes it a valuable resource for anyone aiming to excel in the dynamic field of corporate finance. Accessible learning, practical content, and global relevance characterize CFI’s free course offerings.

Also Read:

I like what you guys tend to be up too. This kind of clever work

and exposure! Keep up the good works guys I’ve added you guys to

my blogroll.

I love it when people come together and share ideas. Great blog, continue the

good work!

I visit every day a few blogs and information sites to read posts, however this blog provides feature based writing.

I am actually pleased to glance at this weblog posts which includes tons of valuable information,

thanks for providing these information.