Introduction

Debt financing refers to the practice of borrowing money from external sources, such as banks or financial institutions, to finance business activities or investments. Compared to equity financing, where companies raise capital by selling shares of ownership to investors, debt financing is generally considered a cheaper source of finance.

This is because the cost of debt is usually lower than the cost of equity, as debt providers expect to receive a fixed rate of return on their investment, while equity investors typically expect a higher rate of return due to the higher risk involved. In this way, companies can benefit from the advantages of debt financing, such as lower costs and tax benefits, while also managing their debt levels to avoid financial distress. In this introduction, we will explore the reasons Debt Financing is a Cheaper Source of Finance. Let’s dive in!

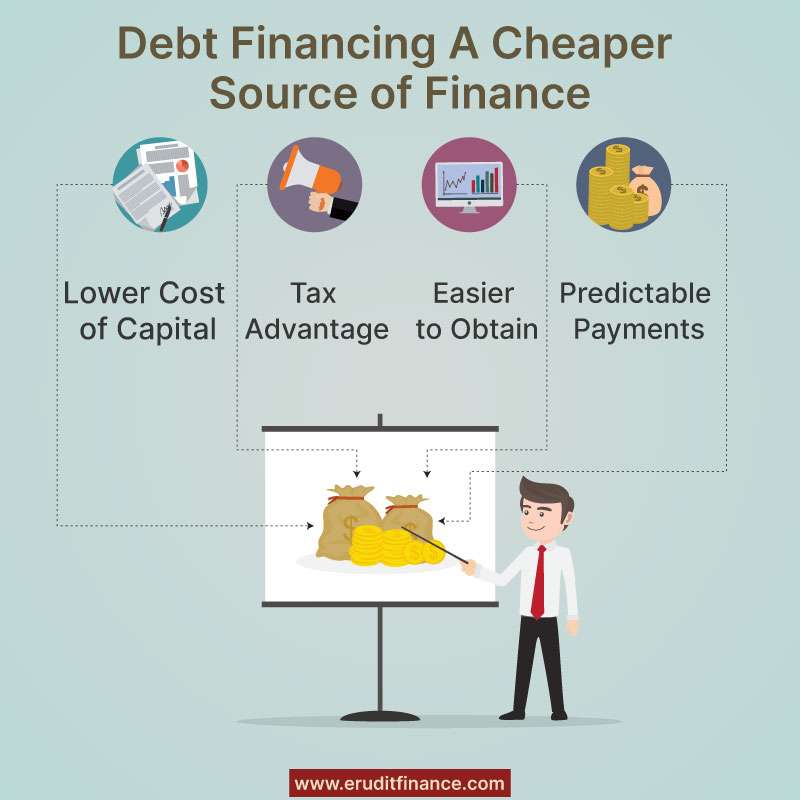

Why Debt Financing is a Cheaper Source of Finance

Debt financing is often considered a cheaper source of finance compared to equity financing for several reasons.

1. Lower Cost of Capital- Debt financing is often cheaper than equity financing because the cost of debt is typically lower than that of equity. Debt typically has a fixed interest rate, which makes it less risky for investors, and therefore, less expensive for businesses to raise capital.

2. Tax Advantage- Interest paid on debt is tax-deductible, which reduces a company’s taxable income and, as a result, reduces the overall cost of debt financing.

3. No Dilution of Ownership- Debt financing does not dilute the ownership of the company, meaning that existing shareholders do not have to give up any ownership in the business to raise capital. In contrast, equity financing involves issuing new shares, which can dilute the ownership of existing shareholders and reduce their share of future profits.

4. Predictable Payments- Debt financing involves making regular fixed payments, which makes it easier for businesses to plan their cash flows and manage their financial obligations. Equity financing, on the other hand, does not involve fixed payments, and the amount of dividends paid to shareholders depends on the company’s profitability.

5. Easier to Obtain- Debt financing is often easier to obtain than equity financing because lenders are primarily interested in the borrower’s ability to repay the loan and are less concerned with the potential for future growth and profits.

Overall, debt financing can be a cheaper source of finance for businesses. However, it’s important to note that taking on too much debt can also be risky, as high debt levels can make it more difficult for a business to meet its financial obligations and limit its ability to invest in future growth.

Why is Debt Cheaper than Equity Example?

Let’s consider an example to understand why debt financing is often cheaper than equity financing.

Suppose a company XYZ is looking to raise $1 million to fund its expansion plans. It has two options: to issue new equity or to borrow the money through debt financing.

If the company decides to issue new equity, it will have to sell new shares to investors, which will dilute the ownership of existing shareholders. Additionally, equity investors will expect a return on their investment in the form of dividends and capital gains, which can be unpredictable and may vary based on the company’s performance.

On the other hand, if the company decides to borrow money through debt financing, it can obtain the funds by issuing bonds or taking out a loan. The lender will charge interest on the loan or bond, but the repayment terms will be fixed and predictable. Additionally, interest paid on debt is tax-deductible, which reduces the overall cost of debt financing.

Of course, this is just a simplified example, and the actual costs of debt and equity financing will depend on various factors such as the creditworthiness of the borrower, prevailing interest rates, market conditions, and investor expectations. Nonetheless, this example illustrates why debt financing can be a cheaper source of finance than equity financing for companies.

Why Does Debt Increase with Inflation?

Debt can increase with inflation because inflation erodes the value of money over time. Inflation reduces the purchasing power of money, which means that the same amount of money can buy fewer goods and services over time.

When a borrower takes out a loan, they agree to repay the loan amount along with interest over a specified period. The interest rate charged on a loan reflects the cost of borrowing money and also compensates the lender for inflation risk. If inflation increases, the value of the money repaid by the borrower decreases, which means that the lender receives less value than they would have received if there had been no inflation.

To compensate for the inflation risk, lenders typically charge a higher interest rate when inflation is high. This means that borrowers have to pay a higher interest rate on their loans when inflation is high, which increases the overall cost of borrowing and leads to an increase in the amount of debt.

In summary, debt can increase with inflation because inflation reduces the purchasing power of money, which leads to higher interest rates charged by lenders to compensate for inflation risk, and ultimately leads to an increase in the overall cost of borrowing.

Disadvantages of Debt Financing

Debt financing can have several disadvantages for businesses, including

Financial Risk- Taking on debt increases the financial risk of the business, as the company has to make regular payments to lenders regardless of the business’s performance. If the company is unable to make the payments, it may default on the loan, which can damage the company’s credit rating and lead to legal action.

Interest Payments- Interest payments on debt can be a significant financial burden for businesses, especially if interest rates rise or the company has taken on too much debt. High-interest payments can limit the company’s ability to invest in growth opportunities and can reduce the profitability of the business.

Covenants and Restrictions– Lenders often place covenants and restrictions on loans, which can limit the company’s financial flexibility and restrict its ability to make strategic decisions. For example, lenders may require the company to maintain certain financial ratios or limit the amount of additional debt the company can take on.

Reduced Control- Debt financing requires the borrower to make regular payments to lenders, which reduces the company’s control over its cash flow. This can limit the company’s ability to make investments or pay dividends to shareholders.

Credit Rating– Taking on too much debt can damage the company’s credit rating, which can make it more difficult and expensive for the company to borrow money in the future.

Overall, while debt financing can be an effective way to raise capital, it is important for businesses to carefully consider the potential risks and costs associated with taking on debt. Businesses should weigh the advantages and disadvantages of debt financing against other sources of finance, such as equity financing, and choose the option that best suits their needs and financial situation.

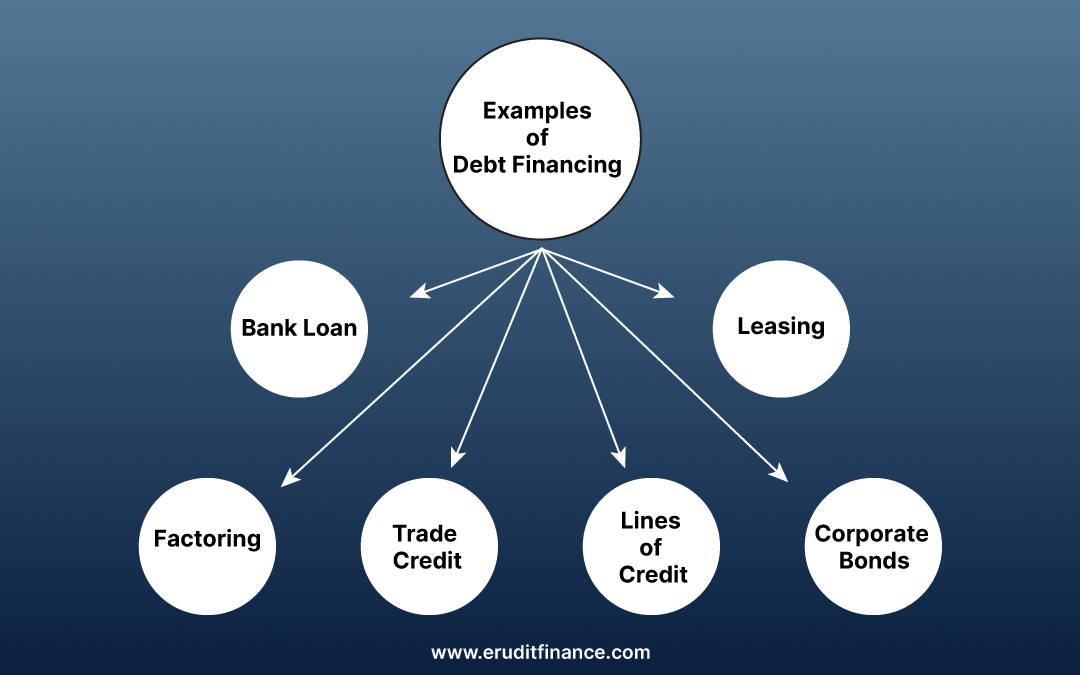

What are Examples of Debt Financing?

There are various examples of debt financing, including

| Bank Loan | Corporate Bonds | Lines of Credit |

| Trade Credit | Factoring | Leasing |

Bank Loan- Bank loans are a common form of debt financing, where a business borrows money from a bank and agrees to pay it back over a specific period with interest.

Corporate Bonds- Bank loans are a common form of debt financing, where a business borrows money from a bank and agrees to pay it back over a specific period with interest.

Lines of Credit- A line of credit is a type of loan that allows a business to borrow up to a certain amount of money from a bank or other financial institution as needed. Interest is charged only on the amount borrowed, and the company can repay and borrow funds as required.

Trade Credit- Trade credit is a type of short-term debt financing where a business purchases goods or services from a supplier on credit and agrees to pay for them at a later date.

Factoring- Factoring is a type of debt financing where a business sells its accounts receivable to a factoring company at a discount in exchange for immediate cash.

Leasing- Leasing is a type of debt financing where a business leases equipment or other assets from a leasing company in exchange for regular payments over a specific period.

These are just a few examples of debt financing options available to businesses. The specific type of debt financing that a business chooses will depend on its financial situation, borrowing needs, and other factors. It’s important for businesses to carefully consider the terms and conditions of any debt financing option and ensure that it aligns with their long-term financial goals.

What’s the Difference Between Debt Financing and Equity Financing?

The main differences between debt financing and equity financing are

Ownership: Debt financing does not involve selling ownership of the company, while equity financing involves selling ownership to investors.

Risk and Reward: In debt financing, the lender is entitled only to the repayment of the principal amount plus interest, regardless of the company’s financial performance. In equity financing, investors share in the company’s profits and growth potential but also face the risk of losing their investment if the company does not perform well.

Control: With debt financing, the company retains control over its operations and strategic decisions, while equity financing may require the company to give up some control over investors.

Repayment: Debt financing requires regular payments of principal and interest, while equity financing does not require any repayment but may require the payment of dividends to shareholders.

In summary, debt financing involves borrowing money that must be repaid with interest, while equity financing involves selling ownership stakes in the company to investors. Both financing options have their advantages and disadvantages, and the choice between them will depend on the company’s financial situation, growth potential, and long-term goals.

Bottomline

Hope, you enjoyed reading the article on why Debt Financing is a Cheaper Source of Finance.

Comment below with your doubts.