Introduction

Richard Musgrave, hailed as the father of public finance, made indelible contributions to the field. Pioneering the study of government expenditures and taxation, his work laid the groundwork for contemporary fiscal policies. Musgrave’s insights into the role of the state in managing economic affairs have shaped the way governments approach public finance globally. His enduring legacy continues to influence scholars, policymakers, and practitioners, fostering a deeper understanding of the intricate relationship between public expenditure, taxation, and the broader economic landscape.

Who was Professor Musgrave?

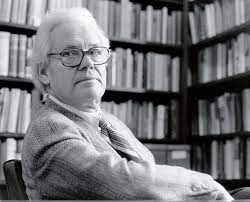

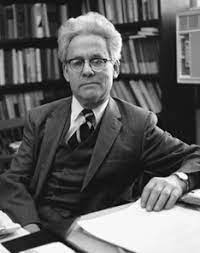

Professor Richard Abel Musgrave (1910–2007) stands as a luminary in the realm of economics, particularly renowned as the “father of public finance.” Born in Königstein im Taunus, Germany, Musgrave’s intellectual journey traversed continents, leaving an indelible mark on economic scholarship and policy formulation.

RephraseAt Heidelberg University, Musgrave completed his economics doctorate in 1933. The Great Depression and the Nazi’s growth spiced up his early years. Aiming to evade political torment, he moved to the U.S. in 1938. Repeat, he headed to the U.S. in 1938. This kicked off a work-life that greatly molded the topography of public money matters and economic belief.

Musgrave’s educational achievements peaked in his Harvard University tenure, earning professorship in 1948. His groundbreaking piece, “The Theory of Public Finance,” penned with Peggy Musgrave in 1959, still stands as a base in the field. This impactful book detailed the basic tenets of government spending, taxes, and the complex relationship between them.

Musgrave’s contributions extended beyond theoretical frameworks. He sought to understand the role of the state in managing economic affairs, emphasizing the importance of government intervention in addressing market failures and promoting societal welfare. His three-tier classification of government expenditure—allocative, distributional, and stabilizing—became a framework for analyzing public spending.

Throughout his career, Musgrave’s influence resonated in various capacities. He served as an economic advisor to the U.S. government, offering insights into fiscal policy. His ideas on fiscal federalism, emphasizing the role of decentralized decision-making in government finance, gained prominence.

Apart from studying, Musgrave played a vital role in molding the world economy. Being part of places like the International Monetary Fund (IMF) and the United Nations (UN) showcased his dedication to worldwide economic management. He added to talks about economic development and pushed for strategies that tackled unequal global wealth.

Musgrave’s impact reverberated not only in the realm of academia but also in public policy. His work guided policymakers in understanding the implications of taxation and public expenditure decisions on economic outcomes. His legacy extends to generations of economists, policymakers, and students who continue to draw inspiration from his pioneering insights.

Beyond the accolades and intellectual achievements, Musgrave’s character was marked by a deep sense of responsibility and ethical commitment. His life reflected a dedication to advancing economic knowledge for the betterment of society, transcending the confines of academic discourse.

Richard Abel Musgrave’s passing in 2007 marked the end of an era, but his legacy endures. The foundations he laid in public finance theory and policy continue to shape discussions on the role of government in economic affairs. As the “father of public finance,” Professor Musgrave’s enduring influence serves as a testament to the enduring power of ideas in shaping the economic landscapes of nations.

What is Musgrave Theory?

Musgrave’s Theory, often referred to as the Musgravian Approach is a seminal contribution to the field of public finance formulated by economist Richard Abel Musgrave. His theories, extensively detailed in his influential work “The Theory of Public Finance” (1959), have significantly shaped the understanding of government finance and fiscal policy.

The Musgravian Approach focuses on the economic role of the state and the principles governing government expenditures and taxation. Key elements of Musgrave’s theory include:

A). Classification of Government Expenditure:

Musgrave proposed a three-tier classification of government expenditure:

| Allocative Expenditure: Government spending to allocate resources efficiently and address market failures. |

| Distributional Expenditure: Government intervention to promote income redistribution and address social inequalities. |

| Stabilizing Expenditure: Measures to stabilize the economy during economic fluctuations, such as counter-cyclical fiscal policies. |

B). Optimal Taxation:

Musgrave delved into the concept of optimal taxation, aiming to strike a balance between raising revenue for government operations and ensuring equity in the distribution of the tax burden. He emphasized the importance of considering both efficiency and equity when designing tax systems.

C). Fiscal Federalism:

Musgrave’s work also contributed significantly to the theory of fiscal federalism. He explored the optimal division of fiscal responsibilities between different levels of government, highlighting the need for decentralized decision-making to address regional disparities effectively.

D). Public Goods Theory:

Musgrave expanded the theory of public goods, emphasizing the role of government in providing goods and services that the private market may undersupply due to non-excludability and non-rivalry. He argued for government intervention in the provision of public goods to ensure societal welfare.

E). Role of the State:

Musgrave advocated for an active role of the state in managing economic affairs. He contended that the government should intervene when market mechanisms fail to achieve allocative efficiency, promote income redistribution, or stabilize the economy.

Musgrave’s Theory has become foundational in the study of public finance, guiding policymakers and economists in understanding the rationale behind government interventions in the economy. The framework provided by Musgrave continues to be influential in discussions on fiscal policy, taxation, and the broader role of government in promoting societal welfare and economic stability.

Who is the Father of Finance in India?

Often, folks call R. K. Shanmukham Chetty the “Father of Finance in India.” This Indian economist and statesman played a big role during India’s early days as a free country. Serving as India’s Finance Minister from 1947 to 1948, Shanmukham Chetty had a major role in developing India’s financial rules in this crucial period of its history.

Working as Finance Minister, Chetty was vital in forming the country’s economic structure. The groundwork for India’s economy was laid through his policies and institutions. Many people have indeed contributed to India’s finances, but many see R.K. Shanmukham Chetty as essential during early finance strategy planning for the country.

Who is the Father of Public Finance in India?

The title “Father of Public Finance in India” is often attributed to K.C. Neogy. He was an eminent Indian economist and served as the first Indian Finance Member of the Viceroy’s Executive Council from 1945 to 1947.

Neogy played a crucial role in shaping India’s fiscal policies during the pre-independence and early post-independence periods, making significant contributions to public finance in the country. While the title may be subjective and several individuals have contributed significantly to the field, K.C. Neogy is recognized for his pivotal role in formulating financial strategies during a crucial phase in India’s history.

Bottomline:

In the realm of Public Finance, Richard Abel Musgrave, hailed as the “father of public finance,” stands as a pioneering figure whose insights and theories have profoundly shaped our understanding of government expenditures, taxation, and the economic role of the state. His seminal work continues to be a guiding force, influencing scholars, policymakers, and practitioners worldwide. Musgrave’s enduring legacy lies in the intellectual foundation he laid, emphasizing the intricate relationship between public finance and societal welfare, an indispensable compass for navigating the complexities of economic governance.

Also Read-