Introduction

Welcome to the Personal Finance Course made for India. In this all-round program, we’ll study the main ideas that help you with money matters in India. This course helps you learn important skills like saving money and understanding investments and taxes. It also teaches retirement planning in a way that makes sense to everyone. Learn about the parts of India’s bank system, get to know tax planning, and investigate risk management using insurance. Come with us on this trip to create a solid base in money matters. This will help you make smart choices and grow wealth for your plans that match what you want.

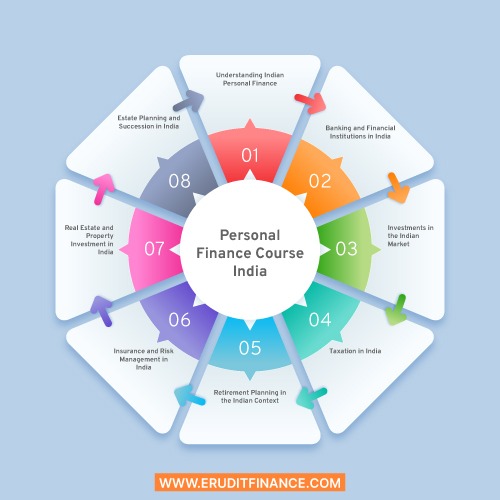

Personal Finance Course India

Welcome to the “Personal Finance Course India,” a comprehensive program tailored to equip you with the knowledge and skills necessary for effective financial management in the Indian context. This course is designed to empower individuals with practical insights and strategies to navigate the unique financial landscape of India, addressing key aspects of personal finance.

Course Overview:

| Module 1: Understanding Indian Personal Finance |

| Module 2: Banking and Financial Institutions in India |

| Module 3: Investments in the Indian Market |

| Module 4: Taxation in India |

| Module 5: Retirement Planning in the Indian Context |

| Module 6: Insurance and Risk Management in India |

| Module 7: Real Estate and Property Investment in India |

| Module 8: Estate Planning and Succession in India |

Module 1: Understanding Indian Personal Finance- Explore the fundamental concepts of personal finance, including budgeting, financial goal setting, and understanding the economic landscape in India.

Module 2: Banking and Financial Institutions in India- Gain insights into the Indian banking system, various types of accounts, interest rates, and the role of financial institutions in shaping the financial sector.

Module 3: Investments in the Indian Market- Delve into the diverse investment opportunities available in India, including mutual funds, stocks, bonds, and real estate. Understand risk and return factors specific to the Indian market.

Module 4: Taxation in India- Navigate the intricacies of the Indian tax system. Learn about income tax, tax-saving instruments, deductions, and strategies for efficient tax planning.

Module 5: Retirement Planning in the Indian Context- Explore retirement planning tools such as the Employee Provident Fund (EPF), Public Provident Fund (PPF), and pension plans to secure your financial future.

Module 6: Insurance and Risk Management in India- Understand the significance of insurance in the Indian context. Explore life insurance, health insurance, and general insurance options to manage financial risks.

Module 7: Real Estate and Property Investment in India- Gain insights into the Indian real estate market, property investment strategies, and the role of real estate in a comprehensive financial portfolio.

Module 8: Estate Planning and Succession in India- Learn the basics of estate planning, wills, trusts, and succession planning to secure your legacy in compliance with Indian laws.

Congratulations on embarking on the journey of mastering personal finance in the Indian landscape. By the end of this course, you’ll have the knowledge and tools needed to make informed financial decisions and build a secure financial future aligned with the unique dynamics of the Indian economy.

How Can I Study Finance for Free?

You can learn finance for nothing by using different online tools and educational places. Here’s a guide to help you learn finance without spending money:

| Coursera | edX | YouTube Tutorials | OpenCourseWare (OCW) | Books and Ebooks |

| websites | Financial News & Blogs | Podcasts | Forums & Discussion Boards | MOOC Platforms |

Coursera- Provides free classes from top schools and places. Search for classes about money, such as “Financial Markets” or “Beginner’s Guide to Business Finance.”

edX- Just like Coursera, edX offers free classes from schools all over the world. Check out classes like “Money for All” or “Handling Money.”

YouTube Tutorials- Many teachers and money experts provide helpful information on YouTube. Places like Khan Academy, YaleCourses, and The Plain Bagel offer helpful money lessons.

OpenCourseWare (OCW)- Schools like MIT and Yale give free access to study stuff, notes from class talks, and job tasks through OCW. Search for classes about money to improve your knowledge.

Books and Ebooks- Use websites like Project Gutenberg or places online that offer free money books. Books such as “Security Analysis” by Benjamin Graham or “A Random Walk Down Wall Street” by Burton Malkiel are usually found.

Financial News and Blogs- Keep up with money news from good sources like Bloomberg, CNBC, or Financial Times. Read finance blogs for detailed articles and knowledge.

Podcasts- Listen to finance-related podcasts like “Planet Money” or “The Dave Ramsey Show“. These will help you learn useful things about money and get advice on managing it.

Forums and Discussion Boards- Join online groups like Reddit’s money forum (r/finance) to ask questions, share ideas and learn from others.

MOOC Platforms- Big websites like Khan Academy, Udemy, and Alison have free finance classes. Search for classes with high ratings and positive reviews.

Library Resources- Go to your local library for books, journals, and magazines about money. Many libraries also have online resources and digital collections available.

Networking- Join with money experts on LinkedIn. Talking and making connections can give you useful knowledge and chances to grow.

Money Management Course Free

Certainly! Here are free sources and platforms where you can access money management courses.

| Khan Academy | MIT OpenCourseWare | YouTube | National Endowment for Financial Education (NEFE) |

| Coursera | Alison | MyMoney.gov | Smart About Money (SAM) |

| edX | Investopedia |

Khan Academy- Khan Academy provides a range of free finance classes. They cover subjects such as making budgets, saving money, investing, and retirement plans.

Coursera- Coursera gives free lessons from the best schools and places. Search for money-handling classes from places like the University of Illinois or the University of Michigan.

edX- Like Coursera, edX also provides free courses from universities all over the world. Check out money-related lessons from places like MIT or the University of British Columbia.

MIT OpenCourseWare- MIT in Massachusetts gives free use of materials for different money classes. Look at their “Money Management” or “Investments” classes.

Alison- Alison provides many free money-handling classes, like “Learn About Money” and “Starting With Banks.”

Investopedia- Investopedia is a great tool for learning about money stuff. They have many articles, guides, and learning stuff on different money matters.

YouTube- Lots of teachers and money experts share helpful information on YouTube. Sites like Khan Academy, The Financial Diet, and The Plain Bagel give easy-to-understand tips on managing money.

National Endowment for Financial Education (NEFE)- NEFE provides a group of free online classes on subjects like money-saving, investing, and credit management. The classes are made to boost understanding of money.

Smart About Money (SAM)- SAM provides free online lessons and tools for personal money matters such as making a budget, saving cash, or investing.

MyMoney.gov- The US government site about money learning has free things like help, tools, and courses. Topics include spending wisely, saving cash, and avoiding cheating tricks.

Don’t forget to check different places so you can find the way of learning and stuff that works best for what you need. Some sites might give you papers saying “done” which can be put on your job history or LinkedIn page.

Which Course Is Best for Finance in India?

Picking the top money class in India relies on what career goals you have, your schooling background, and personal choices. Some classes focus on various parts of money management. Here are some popular finance courses in India.

Chartered Financial Analyst (CFA)

The CFA program is well-known and highly valued all over the world. It talks about many money things like studying investments, controlling your portfolio, and doing the right thing. It’s good for people who want to learn about banking money, managing assets, and analyzing finances.

Master of Business Administration (MBA) in Finance

Getting an MBA with a focus on money from a well-known business college is often good and important. It gives a complete view of many money-related things and lets you into lots of jobs in finance.

Certified Financial Planner (CFP)

The CFP certification is perfect for people who want jobs in financial planning and guidance. It includes topics like planning for retirement, organizing taxes, and managing estates. This certification is very useful for people who want to be financial planners.

Company Secretary (CS) with a Financial Market Module

A Secretary who knows about the money market is good for people interested in how companies are run, following rules and regulations on finance. It’s a special mix that can result in jobs handling money for big companies.

Financial Risk Manager (FRM)

The FRM certification is for people who want to learn about risk management, especially in the banking and money business area. It deals with issues like market danger, debt risk, and business safety.

Post Graduate Diploma in Banking and Finance (PGDBF)

Many schools offer this diploma for people who want a job in banks and money services. It talks about things like how banks work, handling dangers, and looking at money stuff closely.

Certified Public Accountant (CPA)

While it is a U.S.-focused qualification, the CPA is recognized globally and can be beneficial for those interested in accounting, auditing, and financial reporting.

Financial Modeling Courses

Several short-term courses and certifications in financial modeling are available online. These are beneficial for individuals interested in roles such as financial analysts or investment bankers.

What Is the Easiest Course in Finance?

Knowing the “easiest” school subject in money matters is different for each person and relies on personal skills, likes, knowledge background. But some classes are usually seen as easier or good for newbies. Here are a few options:

Personal Finance Courses- Classes about personal money are often made for people who don’t know much about finances. These classes are about making a budget, saving money, investing, and planning for retirement. They’re easy to understand even if you’re new to it.

Introduction to Finance Courses- Many colleges have beginner finance classes that give a basic view of money ideas without going into hard theories too much. These classes are usually part of bigger business or money-related programs.

Financial Literacy Workshops- Different groups and websites provide free or cheap money-smart lessons. These workshops are made to improve simple money skills and they usually can be used by people who don’t know much, if anything about finances.

Online Platforms (e.g., Khan Academy)- Websites like Khan Academy give free finance classes for beginners. These teach important ideas. These classes usually use easy words and examples from real life to make money more understandable.

Basic Accounting Courses- Classes that teach basic accounting rules can be a good place to start learning about the money side of businesses. These classes often talk about things like balance sheets, income statements, and cash flow.

Financial Planning Courses- Courses about planning money for people or families usually give a simple and useful way to learn finance. They talk about topics like managing money, having insurance, and the basics of investing.

Investing for Beginners Courses- Basic lessons on investing are for newcomers and teach about stocks, bonds, and mutual funds. They might also simply explain basic analysis ideas.

What Is the Most Difficult Finance Course in India?

Finding the hardest finance class in India is a choice. It can change based on how good someone is, what they already know, and their likes or dislikes. But, some classes are famous for being hard and having a lot of information. Here are a few that are often considered challenging.

| Chartered Financial Analyst (CFA) | The CFA program is famous for its tough study plan. It goes over a lot of subjects in money management, like ethics and financial analysis tools to work with investments and manage portfolios correctly. Usually, it takes a lot of time and you need to know quite well about money matters. |

| Financial Risk Manager (FRM) | For people who want to learn about risk management, the FRM certification is very hard. It talks a lot about risks like market risk, credit risk, and operation issues. It needs you to know hard things about sophisticated money tools. |

| Actuarial Science | Actuarial science uses a lot of math and statistics to measure money risks, mainly in insurance areas like pensions. The lessons and tests are hard, students usually try to get different types of certificates. |

| Quantitative Finance Programs | Classes for master’s degrees in finance with numbers are not easy because they need a mix of money, math, and typing skills. These can be hard to learn. These programs usually draw people with good math skills. |

| Ph.D. in Finance | Getting a Ph.D. in finance means doing tough research, lots of studying, and knowing financial theory very well. Usually, it is seen as one of the hardest ways in that area. |

| Advanced Financial Modeling Courses | Classes that study money math in depth, especially those using hard ways to figure out worth and different situations can be tough for people who don’t know numbers well. |

It’s key to remember that something hard for one person may not be difficult for another.

What Is the Highest Paying Jobs in Finance in India?

In India, there are several good-paying jobs in the finance sector. But remember, pay structures can change depending on things like experience or education. It also depends on the industry and company you work for. Here are some of the highest-paying jobs in finance in India:

A). Investment Banker- Top-level investment bankers can make a lot of money from their salaries. They are very important in guiding people about money deals, buying and selling businesses, and getting funds.

B). Private Equity Professional- People who work in private equity, and take care of money investments or make important financial choices often get big paychecks. This area is especially good for people who have experience and a history of success.

C). Hedge Fund Manager- People who manage investment money in hedge funds can get paid lots of money and bonuses based on how well they do.

D). Chief Financial Officer (CFO)- CFOs are top bosses who watch over the money things of a company. They have an important role in making choices, and their pay shows the jobs they do as leaders.

E). Financial Analyst (Chartered Financial Analyst – CFA)- Financial analysts who are good and have a CFA title can make big money. They often work in jobs that involve looking at where to put money and managing collections of investments.

F). Risk Manager- People who manage risk, especially those in financial companies, have the job of finding and lessening dangers. Their jobs are very important for keeping money balance, and they can earn good wages.

G). Actuary- In the insurance and pension business, there is a need for actuaries who use math and statistics to study money risks. With experience and skill, they can make a lot of money.

H). Derivatives Trader- People who work with derivatives, especially those who are successful, can make a lot of money from their jobs. This job requires knowing and looking after money things in the market.

I). Treasury Manager- Treasury managers, responsible for managing an organization’s financial assets, liabilities, and liquidity, can command high salaries, especially in larger corporations.

J). Management Consultant (Financial)- Management consultants specializing in financial advisory services, providing strategic financial guidance to businesses, can earn high consulting fees.

Bottomline:-

In conclusion, the “Personal Finance Course – India” is your gateway to mastering essential financial skills tailored to the Indian context. From understanding the nuances of the Indian banking system to navigating investment opportunities and tax planning intricacies, this course equips you with practical knowledge for informed decision-making. Whether you’re delving into retirement planning, exploring insurance options, or learning about estate planning, each module is crafted to empower you on your financial journey. By the course’s end, you’ll possess the tools needed to manage resources effectively and build a secure financial future aligned with the dynamic landscape of the Indian economy.

Also Read-

Thankful doesn’t even begin to describe how we feel about your readership. You mean so much to us.

I don’t even know how I ended up here, but I thought this post was good. I do not know who you are but certainly you are going to a famous blogger if you aren’t already 😉 Cheers!