Introduction Project Finance vs Corporate Finance

Businesses use two different financial approaches–Project Finance vs Corporate Finance. Corporate finance deals with the overall financial activities of a company. Project financing is simply one method to raise funds for particular ventures or undertakings. The role of corporate finance is to develop an optimal capital structure, manage cash flows, and make investment decisions to maximize shareholder value.

For instance, project finance means raising funds for a specific project with its own separate legal and financial structure. Normally project finance is employed in large-scale infrastructure or development projects, and the assets of which produce cash flows serve as collateral. Each approach has an important place in financial management, each with its own scope, objectives, and risk profiles to meet different financial needs within a business.

What Is Difference Between Corporate Finance and Project Finance?

In the business hemisphere, there are two different branches of financial science–corporate finance and project finance. Here are the key differences between the two:

| Corporate Finance | Project Finance | |

| Scope: | Covering all aspects of a firm’s financial operations, from managing its capital structure to making investment decisions and formulating an overall financial strategy aimed at contributing most to shareholder value. | Concentrates on raising funds for a specifically defined project that generally requires the establishment of another legal and financial structure. It is customized to suit the financial needs of a given venture. |

| Objective: | The mission of the treasury department is to optimize company capital structure, manage cash flow, and make strategic financial decisions that help improve overall financial health and value across all segments of our operations. | Structures the financing around project cash flows and assets to fund a specific undertaking. The goal is to protect the financial health of this project and reduce risk for all its stakeholders. |

| Risk Allocation: | Manages a range of risks for the entire business. Risk is usually diversified among different business activities. | Requires a phone. Assets and cash flows are also often used as collateral, risk concentrates more on the project itself. |

| Collateral and Security: | Usually collateral is a company’s total assets plus future earnings. | Its assets and cash flows are therefore the major collateral for the project. Repayment is dependent on the income stream promised by the project. |

| Financing Structure: | Typically depends on the overall creditworthiness and financial soundness of the company. Funding is provided in a combination of debt and equity. | Funding is project-oriented, and the cash flows of a given project play an important role. Financing can take the form of project-based loans, either limited-recourse or non-recourse |

| Duration of Financing: | Ongoing and continuous, as it involves managing the company’s financial activities over the long term. | Tied to the specific duration of the project. Financing arrangements are often structured to align with the project’s lifecycle. |

In summary, while corporate finance deals with the broader financial management of an entire company, project finance is a specialized approach focused on securing funding for specific ventures, with a unique financial and legal structure tailored to the needs of that particular project.

What Is the Difference Between Project Finance and Structured Finance?

Project finance and structured finance are both specialized financial approaches but differ in their focus and application:

| Project Finance | Structured Finance | |

| Scope: | Primarily concerned with securing funding for specific projects, often large-scale infrastructure or development initiatives. The financing is tied to the cash flows and assets of the project, and the project operates as a standalone entity. | Involves creating complex financial structures to optimize the funding and risk management for a variety of assets, including loans, securities, or portfolios. It is a broader concept that can be applied to various financial transactions. |

| Application: | Applied when funding is needed for a single, identifiable project with a specific revenue stream. The financing structure is often tailored to the unique risks and characteristics of that project. | Applied in a variety of contexts, such as securitization, where financial instruments are pooled and repackaged to create securities with different risk profiles. It is commonly used in real estate, asset-backed securities, and other financial markets. |

| Focus on Assets: | Primarily focused on the assets and cash flows of the specific project being financed. The project’s revenue stream is a key factor in determining the financing structure. | Focuses on creating financial instruments that are backed by pools of diverse assets, providing investors with exposure to a range of risks and returns. |

| Risk Management: | Involves a detailed assessment and allocation of risks associated with a particular project. Risks are often concentrated on the project itself, and the financing structure is designed to mitigate these risks. | Aims to create financial instruments that effectively manage and distribute risks. It often involves the use of derivatives, credit enhancements, and other tools to optimize risk and return profiles. |

| Duration: | Tied to the specific duration of the project being financed. The financing is structured to match the lifecycle of the project. | Can be applied to both short-term and long-term financial arrangements, depending on the nature of the assets and transactions involved. |

In summary, while project finance is specifically tailored to fund individual projects, structured finance is a more versatile concept applied to various financial transactions, involving the creation of complex financial structures to optimize risk and return in a broader context.

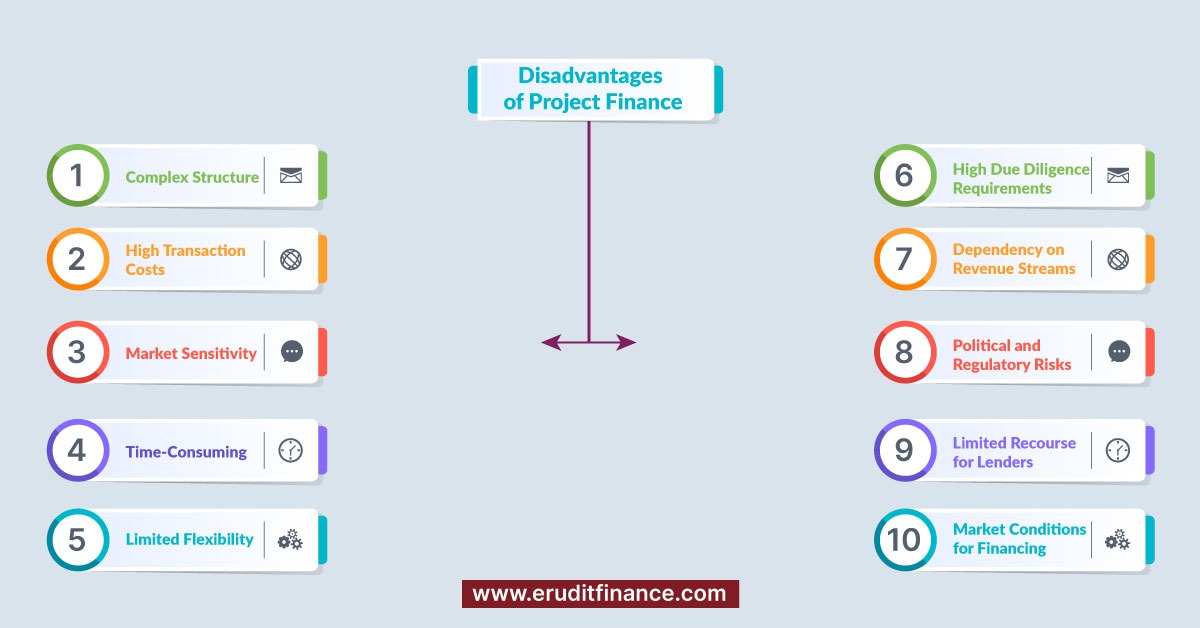

What Are the Disadvantages of Project Finance?

While project finance offers numerous benefits, it also comes with certain disadvantages and challenges. Here are some of the key drawbacks of project finance:

| Complex Structure | High Due Diligence Requirements |

| High Transaction Costs | Dependency on Revenue Streams |

| Time-Consuming | Political and Regulatory Risks |

| Limited Flexibility | Limited Recourse for Lenders |

| Market Sensitivity | Market Conditions for Financing |

Complex Structure: Project finance transactions involve complex legal and financial structures. The intricate arrangements can lead to increased transaction costs and may require specialized expertise, making it challenging for smaller projects.

High Transaction Costs: The structuring, negotiation, and documentation of project finance deals involve significant transaction costs. These costs can be substantial, particularly for smaller projects, and may impact the overall feasibility.

Time-Consuming: Project finance transactions are often time-consuming. The extensive due diligence, negotiation, and approval processes can result in delays, affecting project timelines and potentially causing cost overruns.

Limited Flexibility: The rigid structure of project finance may limit the flexibility of project sponsors. Once the financing structure is in place, making significant changes to the project can be challenging and may require additional negotiations with lenders.

Market Sensitivity: Project finance is sensitive to changes in market conditions, interest rates, and economic factors. Fluctuations in these variables can impact the project’s financial viability and increase the risk for both sponsors and lenders.

High Due Diligence Requirements: Project finance involves thorough due diligence to assess and allocate risks properly. The comprehensive analysis required can be time-consuming and may uncover unforeseen challenges that can impact the project’s feasibility.

Dependency on Revenue Streams: Project finance often relies heavily on the revenue generated by the project to repay debts. If the projected cash flows fall short, it can lead to financial distress and may require renegotiation with lenders.

Political and Regulatory Risks: Projects, especially those in emerging markets, can be exposed to political and regulatory risks. Changes in government policies, regulations, or political instability can impact the project’s financial viability.

Limited Recourse for Lenders: Lenders in project finance typically have limited recourse to the project sponsors. If the project faces financial difficulties, lenders may have limited ability to recover their investments beyond the project’s assets.

Market Conditions for Financing: The availability of project finance can be influenced by market conditions, economic cycles, and the overall appetite for project-related investments. During economic downturns or credit market contractions, obtaining project finance may become more challenging.

Despite these disadvantages, project finance remains a valuable tool for funding large-scale projects. Mitigating these challenges often requires careful planning, risk assessment, and effective management throughout the project’s lifecycle.

What Are the Advantages of Project Finance?

Project finance offers several advantages, making it a popular choice for funding large-scale projects. Here are some key advantages of project finance:

| Risk Allocation | Attracting Private Investment |

| Limited Recourse | Credit Enhancement |

| Enhanced Funding Capacity | Bankability and Project Viability |

| Off-Balance Sheet Financing | Long-Term Financing |

| Tailored Financing Structure | Global Infrastructure Development |

Risk Allocation: Project finance allows for the effective allocation of risks among project stakeholders, including sponsors, lenders, and investors. Each party assumes risks related to their expertise, and this risk-sharing enhances overall risk management.

Limited Recourse: Project finance often involves limited recourse financing, where lenders have a claim only on the project’s assets and cash flows. This limits the impact of project failure on the sponsors’ other assets and businesses.

Enhanced Funding Capacity: Project finance enables the undertaking of large and capital-intensive projects that may exceed the financial capacity of the project sponsors. The project’s standalone nature allows for securing funding based on its own merits and cash flows.

Off-Balance Sheet Financing: Project finance allows sponsors to keep the project debt off their balance sheets, enhancing financial flexibility and creditworthiness. This can be especially beneficial for companies with high levels of existing debt.

Tailored Financing Structure: Each project is unique, and project finance allows for the creation of a financing structure that aligns with the specific characteristics and risks of the project. This customization enhances the feasibility and success of the project.

Attracting Private Investment: Project finance attracts private investment by providing a framework that ensures transparent risk allocation and predictable cash flows. This is particularly important for infrastructure projects that involve public-private partnerships.

Credit Enhancement: Project finance transactions often involve credit enhancement mechanisms, such as guarantees or insurance, which can improve the credit rating of the project and lower financing costs.

Bankability and Project Viability: The rigorous due diligence required in project finance contributes to the bankability and viability of the project. It helps identify potential risks and challenges, increasing the likelihood of project success.

Long-Term Financing: Project finance provides long-term financing solutions that match the project’s lifecycle. This stability in funding is essential for projects with a lengthy development and operational period, such as infrastructure projects.

Global Infrastructure Development: Project finance plays a crucial role in funding global infrastructure development. It attracts international investors and lenders, fostering economic growth and facilitating the execution of essential projects.

In summary, project finance offers a structured and flexible approach to funding large-scale projects, allowing for risk-sharing, customized financing structures, and the attraction of diverse sources of investment. These advantages contribute to the successful execution of complex projects across various industries.

What Are the Key Features of Project Finance?

Project finance is a specialized financial structure used to fund large-scale projects. It is characterized by several key features that distinguish it from traditional financing methods. Here are the key features of project finance:

| Limited Recourse: Project finance typically involves limited recourse, where lenders have a claim only on the project’s assets and cash flows. Sponsors are not personally liable for project debt beyond their initial investment. |

| Standalone Structure: Each project is structured as a standalone entity, separate from the sponsors’ other businesses. This isolation allows for independent financial analysis and risk assessment. |

| Risk Allocation: Risks are allocated among project stakeholders, including sponsors, lenders, and investors. The parties involved assume risks based on their expertise, enhancing risk management. |

| Cash Flow Repayment: Repayment of debt is primarily based on the cash flows generated by the project. Lenders rely on the project’s revenue stream for debt servicing. |

| Special Purpose Vehicle (SPV): Projects are often implemented through a Special Purpose Vehicle (SPV) or Special Purpose Entity (SPE). The SPV is created solely to execute the project and manage its finances. |

| Non-Recourse Financing: In some cases, project finance is non-recourse, meaning lenders have no claim on the sponsors’ assets beyond the project itself. The project’s assets serve as collateral. |

| Project Life Cycle Financing: The financing structure is tailored to the specific life cycle of the project, from development and construction to operation. Debt repayment is structured to match the project’s cash flow profile. |

| Credit Enhancements: Credit enhancement mechanisms, such as guarantees or insurance, may be used to improve the creditworthiness of the project. This can attract more favorable financing terms. |

| Comprehensive Due Diligence: Rigorous due diligence is conducted to assess the technical, legal, financial, and environmental aspects of the project. This thorough analysis is crucial for project viability and risk mitigation. |

| Public-Private Partnerships (PPPs): Project finance is often used in Public-Private Partnerships (PPPs), where private entities collaborate with public entities to develop and operate public infrastructure projects. |

| Customized Financing Structures: The financing structure is customized based on the characteristics of the project, including its industry, risk profile, and revenue generation model. |

| Feature: Long-Term Financing: Project finance provides long-term financing solutions, aligning with the project’s development and operational timeline. This is particularly important for infrastructure and energy projects. |

| International Collaboration: Project finance frequently involves international collaboration, attracting investors and lenders from various jurisdictions. This global participation is common in major infrastructure projects. |

In summary, project finance is characterized by its standalone structure, limited recourse, risk-sharing mechanisms, and a tailored approach to financing that aligns with the unique characteristics of each project. These features make it a preferred method for funding large-scale ventures.

What Does a Project Finance Analyst Do?

A Project Finance Analyst plays a crucial role in the field of project finance, contributing to the assessment, analysis, and management of financial aspects related to large-scale projects. The responsibilities of a Project Finance Analyst may include:

- Financial Modeling: Develop and maintain detailed financial models to analyze the feasibility and financial viability of projects. This involves projecting cash flows, assessing risks, and evaluating potential returns on investment.

- Due Diligence: Conduct thorough due diligence on project opportunities. This includes assessing technical, legal, financial, and environmental aspects to identify potential risks and opportunities associated with the project.

- Risk Assessment: Analyze and assess various risks associated with the project, including market risks, regulatory risks, and operational risks. Develop strategies to mitigate and manage these risks throughout the project lifecycle.

- Market Research: Conduct market research to understand industry trends, market conditions, and competitive landscapes. This information is crucial for making informed financial decisions and assessing the project’s market positioning.

- Financial Analysis: Perform financial analysis, including financial statement analysis, profitability assessments, and financial ratios. Evaluate the financial health of project entities and assess their ability to meet debt obligations.

- Deal Structuring: Assist in structuring financial deals by working with legal and financial teams. Develop financing structures that align with the specific characteristics and risks of the project, considering the interests of various stakeholders.

- Financial Reporting: Prepare and analyze financial reports for internal and external stakeholders. This involves communicating financial performance, key metrics, and potential financial impacts to project sponsors, lenders, and investors.

- Documentation: Prepare and review financial documentation, including loan agreements, financial covenants, and other legal documents related to project finance transactions. Ensure compliance with regulatory requirements and internal policies.

- Communication with Stakeholders: Collaborate with various stakeholders, including project sponsors, lenders, investors, and legal teams. Communicate financial information, risks, and strategies to facilitate decision-making and project execution.

- Monitoring and Reporting: Monitor the financial performance of projects throughout their lifecycle. Report on key financial metrics, deviations from projections, and potential risks to stakeholders. Provide regular updates to support decision-making.

- Budgeting and Forecasting: Develop project budgets and financial forecasts. Work with project teams to ensure that financial goals align with project objectives. Monitor actual performance against budgeted figures.

- Compliance: Ensure compliance with financial and legal requirements. Monitor adherence to financial covenants and regulatory standards outlined in project finance agreements.

- Advisory Services: Provide financial advice and recommendations to project sponsors and other stakeholders. Assist in optimizing financial structures, managing risks, and enhancing overall project financial performance.

A Project Finance Analyst plays a critical role in helping ensure the successful implementation and financial sustainability of large-scale projects through in-depth financial analysis, risk management, and effective collaboration with various stakeholders.

Bottomline:-

Project finance and corporate finance represent distinct financial approaches. Corporate finance involves managing the overall financial activities of a company, optimizing its capital structure, and making strategic decisions to maximize shareholder value. In contrast, project finance is a specialized funding method for individual ventures, often large-scale projects.

Project finance creates a standalone financial structure for each project, with limited recourse to the sponsors, and relies on the project’s assets and cash flows for repayment. While corporate finance focuses on the holistic financial health of the company, project finance tailors financing structures to the unique risks and characteristics of specific projects, allowing for the effective allocation of risks and resources. Both play crucial roles in different financial contexts, offering versatility in addressing the diverse needs of businesses and projects.

Also Read:-