In the realm of Goods and Services Tax (GST), the concept of “reverse charge GST” is a mechanism designed to shift the responsibility of tax payment from the supplier to the recipient of the goods or services. This mechanism has been put in place to ensure smooth tax compliance and enhance tax collection efficiency.

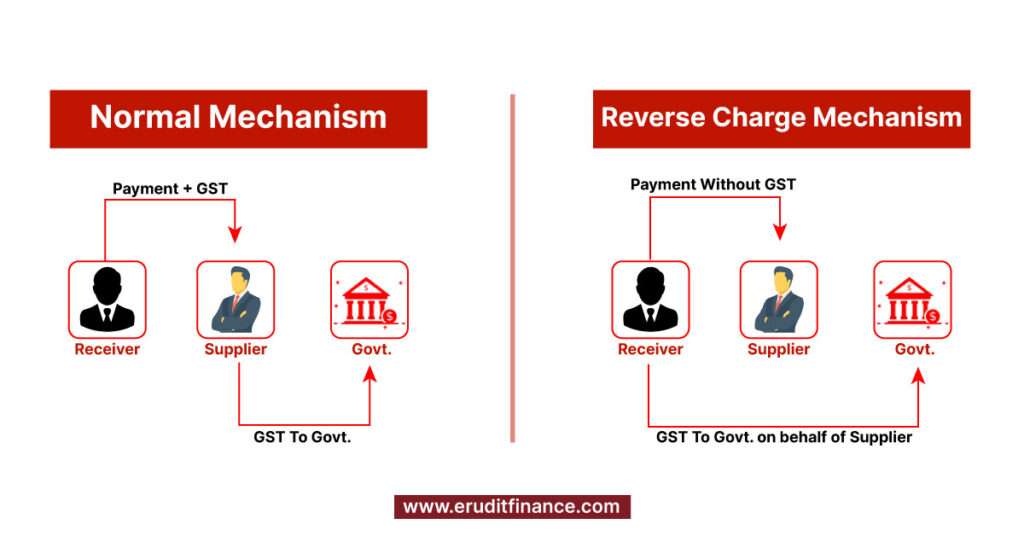

Under normal circumstances, the supplier of goods or services is liable to pay GST to the government. However, under the reverse charge mechanism, the liability shifts to the recipient. This typically happens in specific scenarios outlined by the tax authorities.

What Is Reverse Charge Mechanism?

The Reverse Charge Mechanism (RCM) is a unique provision in the Goods and Services Tax (GST) system where the liability to pay tax is shifted from the supplier to the recipient of the goods or services. In other words, under RCM, it is the buyer or the receiver of the goods/services who is liable to pay the tax instead of the supplier.

How Does Reverse Charge Work?

In the standard scenario of GST, the supplier collects the tax from the recipient and deposits it with the government. However, under the RCM, this responsibility is reversed. Here’s how it typically works

- Supplier-Side- When a registered supplier sells goods or services to a registered buyer, the supplier issues an invoice with GST included.

- Recipient-Side- In a scenario where RCM is applicable, the recipient of these goods/services is responsible for paying the GST directly to the government, instead of the supplier.

When is Reverse Charge Applicable?

RCM is generally applicable under specific conditions, which may vary across jurisdictions. However, common situations where RCM is often applied include

- Specific Goods/Services- Tax authorities identify certain goods or services for which RCM applies. This could include items like legal services, manpower supply, goods transported by road, etc.

- Unregistered Suppliers- If a registered business procures goods or services from an unregistered supplier, the recipient becomes liable to pay GST under RCM.

- E-commerce Transactions- In some cases, for services provided through e-commerce platforms, the operator becomes liable to pay GST under RCM on behalf of the supplier.

What Is the Limit of Reverse Charge?

There are two main limits to consider with Reverse Charge Mechanism (RCM) under GST

- Threshold Limit: A registered taxpayer isn’t liable for RCM if the total value of supplies received from unregistered suppliers in a single day is less than Rs. 5,000.

- Compulsory Registration: Unlike the regular GST registration threshold of Rs. 20 lakh (or Rs. 10 lakh in special cases), anyone paying tax under RCM must be registered under GST irrespective of their turnover. This means even small businesses that wouldn’t normally need GST registration are required to do so if they fall under RCM.

What Is the Difference Between Forward Charge and Reverse Charge?

The key difference between Forward Charge Mechanism (FCM) and Reverse Charge Mechanism (RCM) in GST lies in who is responsible for collecting and paying the tax.

| Feature | Forward Charge (FCM) | Reverse Charge (RCM) |

| Who collects GST | Supplier | Recipient |

| Seller registration | Not mandatory for all supplies | Mandatory for RCM supplies |

| Buyer registration | Mandatory | Mandatory |

| Threshold limit | Rs. 20 lakh (or Rs. 10 lakh in special cases) | Rs. 5,000 per day from unregistered suppliers |

What Is the Benefit of RCM in GST?

The Reverse Charge Mechanism (RCM) in Goods and Services Tax (GST) has several benefits for both the government and businesses. It is designed to enhance tax compliance, broaden the tax base, and ensure equitable distribution of tax liabilities. Here are some key benefits of RCM in GST

- Enhanced Tax Compliance

- Widening of Tax Base

- Efficient Tax Collection

- Level Playing Field

- Reduction in Tax Evasion

- Input Tax Credit (ITC) Benefit

- Simplicity in Compliance

- Better Monitoring of Transactions

Reverse Charge GST (FAQ)

The GST rate under RCM (Reverse Charge Mechanism) depends on the specific good or service being supplied. However, the most common rate applied under RCM is 18% (split as 9% SGST and 9% CGST).

Recipients paying tax under RCM can claim Input Tax Credit (ITC) for the tax paid. This allows businesses to offset the tax they have paid on inputs against the tax liability on their outputs, reducing the overall tax burden.

The GST rates under RCM are the same as those under the regular mechanism. They vary based on the nature of goods or services and are categorized into different slabs like 5%, 12%, 18%, and 28%.

Yes, RCM is applicable for both goods and services. The specific goods/services and scenarios where RCM applies are notified by the tax authorities.

Businesses can refer to official GST guidelines, notifications, and circulars issued by the tax authorities. They can also consult with tax professionals or visit the official GST portal for updates and clarifications.

Here are some common outcomes

- Interest Payment

- Penalties

- Legal Actions

- Blocking of Input Tax Credit (ITC)

- Audit and Scrutiny

- Blacklisting

Bottomline

RCM shifts tax payment responsibility to recipients in specific scenarios. It enhances tax compliance, widens the tax base, and offers ITC benefits. Businesses must maintain records, pay GST on time, and consult professionals. Non-compliance leads to penalties. Understanding RCM is crucial for effective tax management and regulatory adherence.

I do believe all of the concepts you have offered on your post. They’re really convincing and can definitely work. Nonetheless, the posts are too short for newbies. May just you please prolong them a bit from next time? Thank you for the post.

You actually make it seem really easy along with your presentation however I to find this topic to be actually one thing which I think I might never understand. It kind of feels too complex and extremely huge for me. I’m looking forward in your subsequent publish, I will attempt to get the hang of it!

Hello there! This is kind of off topic but I need some advice from an established blog. Is it difficult to set up your own blog? I’m not very techincal but I can figure things out pretty fast. I’m thinking about making my own but I’m not sure where to begin. Do you have any points or suggestions? With thanks

I respect your work, thankyou for all the useful posts.

I think other site proprietors should take this web site as an model, very clean and magnificent user genial style and design, let alone the content. You’re an expert in this topic!

Rattling clean web site, thankyou for this post.

Pretty nice post. I just stumbled upon your weblog and wanted to say that I have truly enjoyed browsing your blog posts. After all I’ll be subscribing to your rss feed and I hope you write again soon!

I’ve been surfing online more than 3 hours nowadays, yet I by no means discovered any interesting article like yours. It is pretty value enough for me. In my view, if all site owners and bloggers made just right content as you probably did, the net can be much more helpful than ever before.

Quality content

This is a game-changer for meIve been stuck on this exact issue, and your advice gave me a whole new approach. So grateful you shared this!

You said it nicely..