In the dynamic realm of business, Corporate Finance stands as the bedrock of strategic decision-making and sustained growth. This blog Importance of Corporate Finance delves into the pivotal role it plays, unraveling the importance of financial planning, risk management, and capital optimization. From fostering fiscal responsibility to steering organizations through market fluctuations, Corporate Finance is the compass guiding businesses toward prosperity. By examining the significance of prudent investment decisions, transparent financial reporting, and efficient resource allocation, we illuminate how Corporate Finance is not just a function—it’s the driving force behind unlocking value, ensuring resilience, and achieving long-term success in the ever-evolving landscape of the business world.

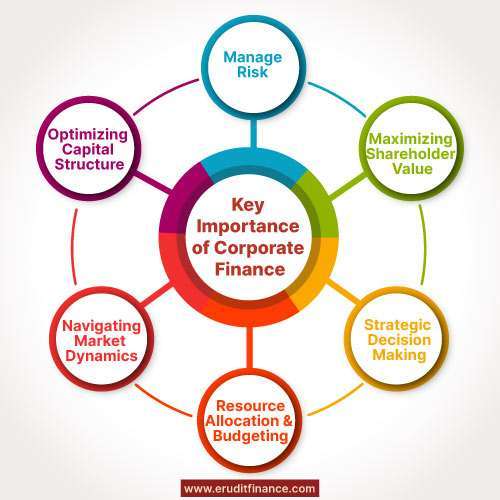

What Is the Key Importance of Corporate Finance?

Corporate Finance plays a central and multifaceted role in shaping the success and sustainability of an organization. Its key importance lies in several critical functions that collectively contribute to strategic decision-making, efficient resource management, and long-term financial health.

| 1). Optimizing Capital Structure: | 5). Risk Management: |

| 2). Strategic Decision-Making: | 6). Maximizing Shareholder Value: |

| 3). Resource Allocation and Budgeting: | 7). Transparent Financial Reporting: |

| 4). Navigating Market Dynamics: |

Optimizing Capital Structure: The main task of one of the corporate finance functions is to select a reasonable combination of debts and shares within one organization’s capital structure. The choice has significant implications for the cost of capital and ultimately affects the entire organization’s financial health as well as the risk profile.

Strategic Decision-Making: Corporate Finance is instrumental in guiding strategic decisions. From evaluating investment opportunities to assessing potential risks, finance professionals provide invaluable insights that enable executives to make informed choices aligning with the organization’s objectives.

Resource Allocation and Budgeting: Efficient resource allocation is crucial for any business. Corporate Finance oversees the budgeting process, ensuring that financial resources are allocated to projects and initiatives that maximize value and contribute to the overall goals of the company.

Risk Management: Identifying, assessing, and mitigating risks are integral components of Corporate Finance. Whether it’s market volatility, currency risks, or operational challenges, finance professionals work to implement strategies that safeguard the organization’s financial well-being.

Maximizing Shareholder Value: Corporate Finance focuses on actions that enhance shareholder value. Through effective capital allocation, dividend policies, and strategic financial planning, finance professionals contribute to the creation of shareholder wealth.

Transparent Financial Reporting: Corporate Finance ensures accurate and transparent financial reporting. This not only fulfills regulatory requirements but also builds trust among stakeholders, including investors, creditors, and the broader financial community.

Navigating Market Dynamics: In a dynamic business environment, Corporate Finance provides the agility needed to navigate market fluctuations. By staying attuned to economic trends and industry shifts, finance professionals position the organization to proactively respond to challenges and seize opportunities.

In summary, Corporate Finance is paramount in aligning financial strategies with overall business objectives. Its importance extends beyond number-crunching; it is the cornerstone for effective decision-making, risk management, and value creation, ultimately contributing to the resilience and prosperity of the organization in an ever-evolving marketplace.

What Is the Most Important Aspect of Corporate Finance?

The most important aspect of Corporate Finance is arguably its role in optimizing the allocation of financial resources. Efficient resource allocation involves making strategic decisions about how to best use the organization’s capital to generate value. This encompasses decisions related to investments, financing, and managing risks. By focusing on effective resource allocation, Corporate Finance ensures that capital is deployed wisely, projects are funded strategically, and the organization maximizes returns on investment. This aspect is pivotal for sustaining financial health, fostering growth, and ultimately enhancing shareholder value, making it a cornerstone of Corporate Finance’s overarching significance.

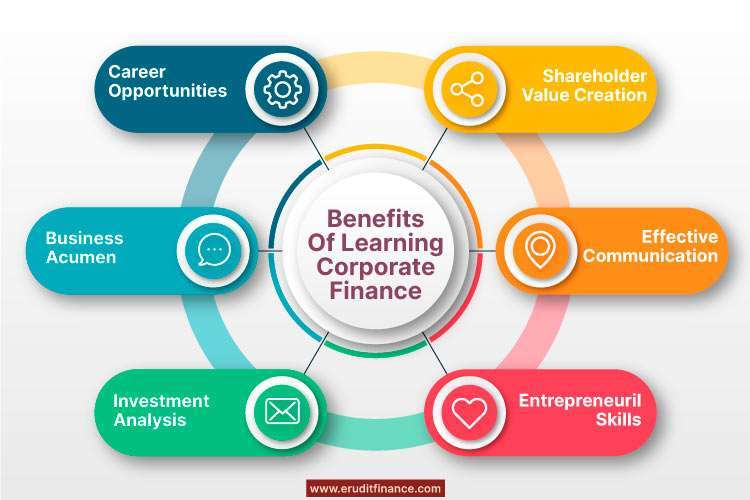

What Are the Benefits of Learning Corporate Finance?

There are many advantages of learning corporate finance both for finance job seekers and people who serve various positions in their businesses. Here are some key advantages.

| Strategic Decision-Making: | Through understanding Corporate Finance, people can think wisely about investment, capital structure as well and financial planning. |

| Career Opportunities: | Proficiency in Corporate Finance enhances career prospects, opening doors to roles such as Financial Analyst, Finance Manager, or Chief Financial Officer (CFO). |

| Business Acumen: | It provides a comprehensive understanding of how financial decisions impact the overall success of a business, fostering a broader business acumen. |

| Risk Management Skills: | Corporate Finance teaches effective risk management, enabling individuals to identify, assess, and mitigate financial risks within an organization. |

| Financial Planning and Budgeting: | Learning Corporate Finance empowers individuals with the skills to develop and manage budgets, aiding in effective financial planning. |

| Investment Analysis: | Individuals gain the ability to analyze potential investments, assess their viability, and understand the expected returns and risks associated with each. |

| Shareholder Value Creation: | Corporate Finance knowledge helps professionals contribute to the creation of shareholder value by making strategic financial decisions. |

| Effective Communication: | Individuals learn to communicate complex financial information effectively, bridging the gap between financial and non-financial stakeholders. |

| Entrepreneurial Skills: | For aspiring entrepreneurs, Corporate Finance knowledge is invaluable for managing finances, securing funding, and driving business growth. |

| Global Business Understanding: | It provides insights into global financial markets, currency fluctuations, and international financial strategies, making it beneficial in a globalized business environment. |

| Adaptability to Change: | Corporate Finance education instills adaptability by teaching individuals how to navigate changes in market conditions, regulations, and economic landscapes. |

| Personal Financial Management: | The principles of Corporate Finance are applicable on a personal level, helping individuals make better financial decisions in their personal lives. |

| Ethical Decision-Making: | Learning Corporate Finance includes an understanding of ethical considerations in financial decision-making, and promoting responsible and ethical practices. |

In essence, learning Corporate Finance is not only beneficial for career advancement but also for developing critical skills that contribute to the success and sustainability of businesses and organizations in today’s dynamic financial landscape.

What Are the Sources of Corporate Finance?

The Sources Are as follows:-

| Equity Financing | Bonds | Trade Credit |

| Debt Financing | Initial Public Offering (IPO) | Leasing |

| Retained Earnings | Private Equity | Grants and Subsidies |

| Bank Loans | Venture Capital | Asset Sales |

| Factoring | Crowdfunding | Mezzanine Financing |

What Are the Important Aspects of Corporate Structure?

Corporate structure refers to the organization and arrangement of various components within a company. It encompasses the relationships, roles, and responsibilities of individuals and departments. Several important aspects contribute to the overall corporate structure:

- Organizational Hierarchy: The hierarchical arrangement of leadership and reporting lines, indicating the levels of authority and responsibility within the organization.

- Departments and Functions: This is the division of the companies into separate departments (for example, accounting, marketing, and production) and the allocation of functions to each group for efficient management of the business.

- Chain of Command: The clear delineation of authority and the flow of decision-making from top-level executives down to lower-level employees, defining the chain of command.

- Communication Channels: The established channels and methods of communication within the organization, facilitate the flow of information horizontally and vertically.

- Decision-Making Processes: The processes and frameworks for making decisions, whether centralized with top management or decentralized with input from various levels of the organization.

- Reporting Structure: The structure that outlines how employees report to their supervisors, managers, and ultimately to top executives, ensuring a clear line of accountability.

- Roles and Responsibilities: Clearly defined roles and responsibilities for each position within the organization to avoid ambiguity and foster efficiency.

- Corporate Governance: The system of rules, practices, and processes by which a company is directed and controlled, ensuring ethical behavior and accountability at all levels.

- Legal Structure: Legal framework encompassing business registration or formation, the type of business entity the company will be classified under, and its applicable and regulatory compliant laws; rights, duties, and responsibilities towards third parties and the government and the public at large; among others.

- Cultural Elements: The shared values, norms, and beliefs that shape the company’s culture, influencing how employees interact and work together.

- Matrix Structures: Organizations may adopt matrix structures where employees report to multiple managers or departments, allowing for greater flexibility and collaboration.

- Workflows and Processes: The design and documentation of workflows and processes that govern how tasks and projects are completed within the organization.

- Resource Allocation: The mechanisms for allocating and managing resources, including human resources, finances, and technology, to support the company’s objectives.

- Adaptability and Flexibility: The changeability of the corporate structure concerns the changes taking place in the business environment, in the industry, and in the company’s mission.

These are some major features that make up an organization’s corporate structure which contributes towards its effectiveness and operation in the achievement of the organization’s goals which allows for a proper working atmosphere.

What Are the Three Main Activities of Corporate Finance?

The three activities of Corporate Finance are:

Capital Budgeting:

This entails appraising potential investments in line with the corporate strategic objectives. Capital expenditure decisions are part of this category and can involve investment into other projects, purchase of assets, or expansion of operations. This approach aims to invest in projects that result in the greatest return on investment and contribute to the long-term value creation for the firm.

Capital Structure:

Capital structure is the combination of debt and equity that a firm utilizes in funding its operational activities as well as investments. The choice of an ideal capital structure has its cost of capital and financial risks considered. These involve deciding how to raise capital through the issuance of stocks and bonds or by lending.

Working Capital Management:

This involves the management of a business’s working capital about its daily operations as well as short-term assets and liabilities. It will involve managing money, sales, goods, and purchases. The proper management of effective working capital enables a firm to hold sufficient working capital to settle for its temporary debts at lower costs.

The main functions constituted by these three actions are collectively referred to as corporate finance. Companies can engage in crucial decision-making based on these figures, as well as direct the distribution and management of resources toward promoting long-term development.

Bottomline:-

“Ultimately, the Importance of Corporate Finance is the linchpin for sustained growth, sound decision-making, and shareholder value maximization—a critical force propelling businesses to long-term success in a dynamic economic landscape.”

Also Read: