The money a business can raise to maintain its operations or expansion plans over a protracted period, usually longer than a year, is referred to as a long-term source of finance. These kinds of funding are crucial for firms that need to make large investments to continue operating or growing. When employed for a variety of things, such as financing fixed assets, new projects, or repaying long-term obligations, long-term financing offers a dependable and predictable source of money. We will explain in detail, What are the Long Term Source of Finance step by step.

Let’s get started.

What are Long Term Sources of Finance Explain the Importance and uses of each Source?

The money that a business can get over more than a year to support its operations or expansion ambitions is known as a long-term source of funding. There are several long-term financing options, including retained earnings, debt, and equity. Let’s delve deeper into each of these sources individually.

| A). Equity Financing | B). Debt Financing | C). Retained Earnings |

A). Equity Financing

Selling ownership shares of a company to investors is a method of raising money. In addition to giving business access to funds that do not need to be returned, equity financing also allows investors to share in the company’s ownership. The benefit of equity financing is that it enables a corporation to raise a sizable amount of money that may be used to finance growth prospects like business expansion, the purchase of other companies, or the investment in new goods. Equity financing, however, can be pricey since investors demand a specific rate of return on their investment, which can reduce the ownership of current shareholders.

B). Debt Financing

Borrowing money from lenders like banks, financial institutions, or private investors is known as debt financing. The borrowed money must be paid back over time, typically with interest. Debt financing enables a business to easily access a sizeable amount of capital without having to dilute ownership, making it a crucial source of long-term funding. Usually, fixed assets like land, buildings, or machinery are financed by debt. Debt financing is significant because it enables a business to use its assets as collateral to acquire money, but it also entails the risk of default if the business is unable to meet its debt payments.

C). Retained Earnings

The profits that a firm has accumulated over time and can reinvest in the company to support its expansion ambitions are referred to as retained earnings. The ability to finance operations or expansion plans without increasing debt or diluting ownership makes retained earnings an essential source of long-term financing for businesses. Reinvesting retained earnings can result in the long-term, sustainable growth of the business. Retained earnings are significant since they show a company’s financial health and stability.

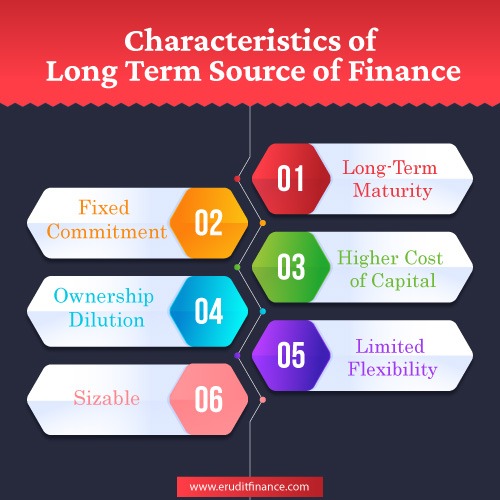

What are the Characteristics of Long Term Source of Finance?

Characteristics of Long-Term Sources of Finance are given below.

| Long-Term Maturity | Ownership Dilution | Higher Cost of Capital |

| Fixed Commitment | Limited Flexibility | Sizable |

1). Long-Term Maturity:

Financial resources with a long-term maturity period have a duration of more than a year. This indicates that the money acquired from these sources is anticipated to be utilized for long-term expenditures requiring large sums of money, including fixed assets, new initiatives, or research & development.

2). Fixed Commitment:

Borrowers of long-term sources of financing must make a fixed promise to pay back the borrowed funds throughout the allotted time period. This means that until the debt is entirely repaid, the borrower must make consistent interest and principal payments to the lender.

3). Higher Cost of Capital:

Compared to short-term sources of finance, long-term sources of financing often have a higher cost of capital. This is because by committing their money to the borrower for a long time, the lender or investor is taking on additional risk.

4). Ownership Dilution:

As new shareholders are included in the ownership structure of the company, long-term financing options that incorporate equity financing may reduce the ownership of current shareholders.

5). Limited Flexibility:

Repayment alternatives, interest rates, and other terms and conditions for long-term sources of financing may be constrained. Due to this, it may be difficult for businesses to modify their finance agreements to take into account shifting business demands or market conditions.

6). Sizable:

Long-term forms of financing are crucial for businesses because they allow them to make sizable expenditures in their current operations or future expansion plans. In the long term, this may result in more profitable growth, improved competitiveness, and sustainable growth.

For What Long Term Finance is Required?

Long-term finance is required by companies for various reasons, including

| A). Purchasing Fixed Assets | D). Acquisitions and Mergers |

| B). Expansion Financing | E). Working Capital |

| C). Research and Development |

A). Purchasing Fixed Assets:

Land, buildings, machinery, and equipment, are frequently financed by long-term lending. These investments are often made using long-term sources of financing because these assets have a long useful life and require significant investment.

B). Expansion Financing:

Businesses could need long-term financing to support their expansion ambitions, which could include adding new branches, exploring new markets, or creating new products. The money is available through long-term loans to finance these expansion potentials.

C). Research and Development:

Businesses may need long-term financing to support their R&D efforts. This involves performing clinical trials for novel medications or medical devices, creating new technology, enhancing existing products, etc.

D). Acquisitions and Mergers:

Businesses may need long-term financing to finance acquisitions and mergers. This includes buying other businesses or assets in order to grow their business, get more market share, or diversify their product line.

E). Working Capital:

Although working capital is normally financed by short-term sources of capital, some businesses may need long-term financing to meet their working capital demands, particularly if those needs are substantial or long-term in nature.

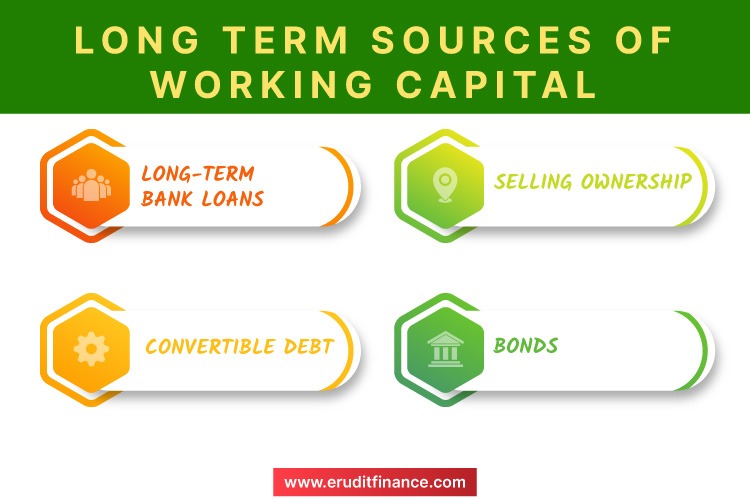

Which is Long Term sources of Working Capital?

Working capital is the money a company needs to finance its regular operations, such as paying employees, paying suppliers, and maintaining inventories. While short-term sources of financing are often utilized to meet working capital needs, some long-term sources of financing can also be used to meet those needs. These enduring sources of operating capital consist of.

a). Long-Term Bank Loans: A loan with a maturity date greater than a year is referred to as a long-term bank loan. These loans can be used to finance working capital requirements, even though they are normally intended to finance long-term investments. This is especially true when a company has significant or ongoing working capital needs.

b). Bonds: A bond is a type of long-term financial instrument that businesses issue to raise money. Bonds, which have a longer time to maturity, can be used to finance working capital requirements, especially if the company has a steady income stream and can produce enough cash flow to pay off the debt.

c). Selling Ownership: Shares in the company to investors in order to raise money are known as equity financing. Even though equity financing is often used to fund long-term investments, it can also be used to finance working capital requirements, particularly if the company has a strong potential for expansion and can provide profits that will satisfy investors.

d). Convertible Debt: A type of debt that has the potential to be converted into equity at a later time. With the possibility of future equity funding, this method of financing offers the flexibility of debt financing. Working capital requirements can be financed with convertible debt, particularly if the company has a strong potential for expansion and has the cash flow to pay down the debt.

Frequently Asked Questions(FAQs):

Share capital, which is the money raised by a corporation by the issuance of shares to shareholders who become part owners of the firm, can be seen as a long-term source of funding. The corporation is not compelled to repay the money raised through the issuance of shares because share capital is a perpetual source of funding and it has no maturity date.

Is a Bank Loan a Long Term Sources of Finance?

Depending on the loan’s maturity time, a bank loan can be a source of financing for either a short- or long-term project. Long-term investments like the purchase of fixed assets, R&D projects, and growth plans are frequently financed with the help of bank loans with maturities longer than one year.

Closing Up

In conclusion, Long Term Source of Finance is essential for a business’s success in the long run since they give it the resources it needs to fund expansion prospects and maintain its financial stability. Every source of financing has advantages and disadvantages of its own, so it is crucial for businesses to thoroughly consider their alternatives and select the best one based on their unique requirements and objectives.

Thank You

Recommended Articles:-

Why Debt Financing is a Cheaper Source of Finance (6 Cost-Effective Solution)

What are the Source of External Finance (Unlocking Ultimate 9 Mystery)