Introduction

Short Term source of Finance refers to funds acquired for a brief period to meet immediate operational needs. These sources, typically utilized for working capital, include bank overdrafts, trade credit, commercial papers, and short-term loans. Their flexibility and quick accessibility make them essential for addressing day-to-day financial requirements, and ensuring smooth business operations. Short-term financing is a strategic tool for businesses to manage cash flow fluctuations and capitalize on opportunities, providing liquidity for short-term obligations and sustaining operational efficiency.

What Is Short Term Financing?

Short-term financing refers to the acquisition of funds to meet immediate operational needs and fulfill short-term obligations. This form of financing is crucial for maintaining day-to-day business activities and ensuring smooth cash flow. Unlike long-term financing, which is geared towards capital investments and has a more extended repayment horizon, short-term financing is focused on addressing immediate financial requirements and managing working capital.

Key features of short-term financing include:

Quick Accessibility: Short-term financing options are designed for rapid acquisition, allowing businesses to access funds swiftly when needed. This agility is vital for addressing sudden expenses or capitalizing on emerging opportunities.

Working Capital Management: Short-term financing is mostly needed by businesses to settle their working capital which includes settling short-term debts, operation expenses, and dealing with fluctuations in their cash flow. This ensures continuity of day-to-day operations in a company without interruption.

Flexibility: Short-term financing provides businesses with the flexibility to adapt to changing financial needs. It is handy during seasonal variations or when facing unpredictable market conditions.

Risk Management: Though short-term credit is provided fast, the business has to be well-equipped to deal with risks that may surface in repaying loans. Prudent planning is essential for short-term financing which may be affected by interest rates and other market conditions.

Bridge to Long-Term Financing: Sometimes, short-term financing acts as bridging finance for long-term funding. This is important in that it allows companies to pay for necessities at the moment while long-term financial deals are put into place.

Effective short-term financing is a strategic tool for businesses to navigate the dynamic financial landscape. Whether addressing unforeseen expenses, taking advantage of trade discounts, or managing seasonal fluctuations, businesses leverage short-term financing to optimize liquidity, maintain operational efficiency, and seize growth opportunities. However, it necessitates careful financial management to ensure that the benefits outweigh the associated costs and risks.

What Are the Types of Short Term Financing?

Short-term financing encompasses various methods businesses use to meet immediate financial needs and manage working capital. The types of short-term financing are diverse, offering flexibility and quick access to funds. Here are some common forms.

Bank Overdrafts

| Description: A revolving credit facility where a business is allowed to withdraw more funds than its account balance. |

| Usage: Ideal for addressing short-term cash flow gaps and unforeseen expenses. |

Trade Credit

| Description: Suppliers allow buyers to defer payment for goods or services, creating a trade credit arrangement. |

| Usage: Common in business-to-business transactions, it provides a grace period for settling invoices. |

Commercial Papers

| Description: Unsecured, short-term debt instruments issued by corporations to raise capital quickly. |

| Usage: Corporations utilize commercial papers to meet short-term obligations, often at a lower cost than traditional loans. |

Short-Term Loans

| Description: Borrowings with a brief repayment period, are commonly offered by banks or financial institutions. |

| Usage: Businesses use short-term loans to cover temporary cash shortages or capitalize on immediate opportunities. |

Lines of Credit

| Description: Pre-approved credit limits from financial institutions that businesses can draw upon as needed. |

| Usage: Provides flexibility for managing working capital and addressing fluctuations in cash flow. |

Factoring

| Description: Selling accounts receivable to a third party (factor) for immediate cash, often at a discount. |

| Usage: Useful for converting receivables into cash quickly, enhancing liquidity. |

Inventory Financing

| Description: Using inventory as collateral to secure a short-term loan. |

| Usage: Assists in optimizing working capital by unlocking the value tied up in inventory. |

Payday Loans

| Description: Small, short-term loans are provided to cover immediate expenses, often with high-interest rates. |

| Usage: Typically used by individuals for personal financial needs. |

Selecting the appropriate type of short-term financing depends on the specific needs and circumstances of a business. Effective utilization requires careful consideration of costs, risks, and the impact on overall financial health.

What Are the Advantages of Short Term Financing?

Short-term financing offers several advantages for businesses, providing them with flexibility, agility, and the means to address immediate financial needs efficiently. Here are the key advantages of utilizing short-term financing.

Quick Access to Funds- Short-term financing options, such as bank overdrafts and lines of credit, provide businesses with rapid access to funds. This agility is crucial for addressing unforeseen expenses or capitalizing on time-sensitive opportunities.

Flexibility- Short-term financing is highly flexible, allowing businesses to adjust their borrowing based on changing financial needs. This adaptability is particularly valuable during periods of fluctuating cash flow or seasonal variations.

Working Capital Management- Short-term financing of working capital is effective for businesses. It covers the daily running cost of operation and reduces the possibility of interruptions during business operations.

Cost-Effective for Immediate Needs- Short-term financing may turn out to be cheaper in some instances where urgent financial matters are encountered. An instance could be using a bank overdraft or trade credits since such facilities are cheaper than long-term loans.

Opportunity Seizure- Short-term financing enables businesses to seize immediate opportunities that may not be feasible with slower, long-term financing methods. This quick access to funds empowers businesses to act promptly.

Seasonal Cash Flow Support- For businesses experiencing seasonal variations in cash flow, short-term financing offers valuable support during periods of increased demand or decreased revenue.

Bridge to Long-Term Financing- Short-term financing may be a stopgap for long-term financing. The strategy enables a firm to tackle urgent matters while awaiting permanent budgetary provisions.

Enhanced Liquidity- Utilizing short-term financing options, such as lines of credit, helps enhance liquidity. This is crucial for maintaining financial stability and meeting obligations as they arise.

Cost Control- Businesses can control costs by strategically using short-term financing only when needed. This prevents unnecessary interest expenses that may accrue with continuous long-term borrowing.

While short-term financing offers these advantages, businesses must carefully manage repayment obligations and consider the associated costs and risks. Prudent financial planning ensures that the benefits of short-term financing contribute positively to overall financial health.

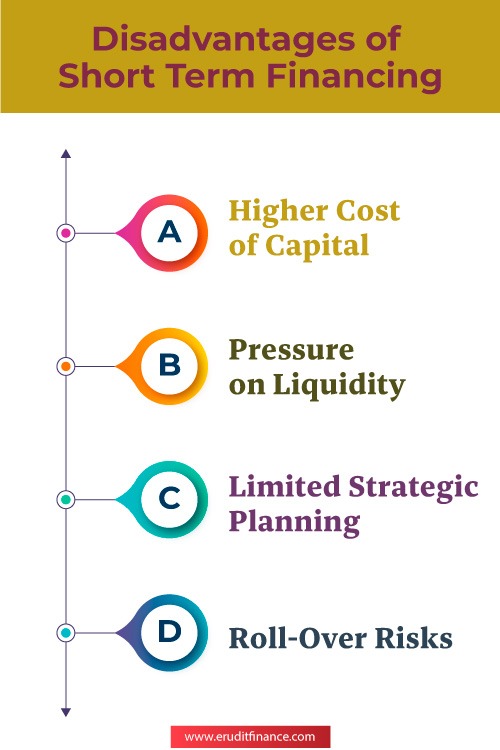

Disadvantages of Short Term Financing

Short-term financing makes business get cash fast but is not without risk which has to be carefully thought of. Here are some key disadvantages of relying on short-term financing.

Higher Cost of Capital: Short-term financing always attracts a higher interest rate than long-term financing. sentences In addition, frequent short-term borrowing adds up and impacts overall profitability.

Uncertainty and Refinancing Risks: Short-term funding is susceptible to market conditions as well as market interest rates. Businesses face interest rate risk when refinancing short-term debt due to increased rates during the period of economic insecurity.

Pressure on Liquidity: Continuous reliance on short-term financing may strain a company’s liquidity. Frequent repayments and interest obligations can put pressure on available cash, impacting the ability to cover day-to-day operational expenses.

Limited Access to Large Amounts: Short-term financing is generally suitable for smaller funding needs. Businesses requiring substantial capital for long-term projects or major expansions may find short-term options inadequate, necessitating a mix of financing sources.

Negative Impact on Credit Rating: Constant short-term borrowing and a high level of debt can negatively impact a company’s credit rating. This can lead to increased borrowing costs and reduced access to favorable financing terms.

Mismatch with Asset Maturity: Short-term financing may not align with the maturity of assets acquired through the funds. This can create a maturity mismatch, with short-term liabilities needing to be repaid before the benefits of long-term assets are realized.

Roll-Over Risks: For short-term debt instruments like commercial papers, there is a risk associated with rollover. If the market conditions are unfavorable during the maturity period, renewing or rolling over the debt may become challenging.

Limited Strategic Planning: Relying solely on short-term financing may limit a company’s ability to engage in long-term strategic planning. The constant focus on meeting immediate financial needs can divert attention from more significant, future-oriented initiatives.

Vulnerability to Economic Downturns: In addition, economic recessions worsen the problems faced by short-term loans. Financial strain may be created by lower revenue, an increase in default risk, and tightening of credit markets during downturns.

Businesses must consider their short-term and long-term financing requirements as well as, risk tolerance and type of business activities when making this decision. Therefore, sound financial management requires a balanced approach towards its short-term requirements of liquidity and long-term goals.

What Is the Difference Between Long and Short Term Source of Finance?

Businesses make use of long-term and short-term finance which helps in meeting different demands and periods. Long-term financing is mainly distinguished from short-term one by goals, repayment terms, and financial instruments used.

| Short-Term Finance: | Long-Term Finance: | |

| Purpose and Use | Used in short-term operational liquidity and current operations. For instance, it is used as an everyday expense cover, for inventory management or simply to meet the short-term fluctuations of cash inflow. | Used in big investments, infrastructural developments like roads, pipelines, and oil refineries which take many years their complete. Serving as investments for acquisitions, research and development, purchasing property (e.g., land and machine), and long-term plans for a bigger future. |

| Repayment Period | Short-term loans that involve borrowing for several days or even a year. Some examples are bank overdrafts, trade credit, and short-term loans. | Entails long-term financing plans exceeding one year. This involves long-term loans, corporate bonds, mortgages, and equity financing. |

| Financial Instruments | Involves financial instruments designed for quick access and immediate needs. Examples include commercial papers, lines of credit, and trade credit. | Utilizes financial instruments structured for larger capital requirements and longer-term commitments. Includes bonds, loans with extended tenures, and equity shares. |

| Risk and Cost | Generally carries lower interest rates but may incur higher costs due to frequent renewals and refinancing. Subject to market fluctuations and refinancing risks. | Involves higher interest rates but provides stability and predictability in terms of interest payments. Lower refinancing risks and exposure to short-term market volatility. |

| Impact on Capital Structure | Often seen as a component of a company’s current liabilities in the capital structure. Used to address short-term obligations without significantly affecting long-term debt levels. | Contributes to a company’s long-term liabilities, shaping its capital structure. It has an impact on the general financial leverage of the firm. |

Effective financial management also involves balancing between long-term and short-term finances. The type of emergency financing, strategic goals, and risk attitude determine the decision between borrowing and equity financing. Generally, a proper finance strategy requires a combination of short-term and long-term options that cover some operational expenses as well as company development.

Bottomline:-

Short-term financing, comprising options like trade credit, bank overdrafts, and commercial papers, serves as a dynamic tool for businesses to swiftly navigate immediate financial needs. Whether addressing working capital requirements, seizing opportunities, or managing day-to-day operations, these flexible solutions optimize liquidity and sustain operational efficiency. Balancing short-term financing with long-term strategies ensures a robust financial foundation, fostering adaptability in dynamic business landscapes.

Also Read:

Excellent post! The advice on diversifying your portfolio is perfect. I’ve been following this strategy, and it’s really been successful. I also created a free resource to help newcomers get started, which your readers might find useful. Great job!