Welcome to the exciting world of the stock market! As a beginner, understanding key terms is crucial. Stocks represent shares in a company, and buying them means owning a piece of that business. The stock market is where these transactions occur. Bull markets signify rising prices and investor confidence, while bear markets indicate the opposite. Market capitalization (market cap) measures a company’s value. Dividends are profits distributed to shareholders. The P/E ratio assesses a stock’s valuation. Diversification involves spreading investments across various assets. Lastly, the Dow Jones Industrial Average and S&P 500 are popular market indices, reflecting overall market performance. Happy investing!

Stock Market Terms for Beginners

| Stocks- Ownership shares in a company. | Bear Market- Falling stock prices & investor pessimism. |

| Portfolio- Collection of owned investments. | Bull Market- Rising stock prices and investor confidence. |

| Volatility- Degree of variation in stock’s price. | Diversification- Spreading investments to manage risk. |

| Dividends- Profits distributed to shareholders. | Market Order- Buy/sell at the current market price. |

| Margin- Borrowed funds to buy stocks. | Sector- Group of related industries in the economy. |

| Limit Order- Buy/sell at a specified price. | Broker- Facilitates stock trades on behalf of investors. |

| Volatility- Degree of variation in stock’s price. | Blue Sky Laws- State regulations to protect investors. |

| Index- Measurement of market performance. | ROE (Return on Equity)- Measure of profitability. |

| P/E Ratio (Price-to-Earnings)- Valuation metric comparing stock price to earnings. | Market Cap- Total value of a company’s outstanding shares. |

| ETF (Exchange-Traded Fund)- Investment fund traded on stock exchanges. | Blue Chip Stocks- Shares in well-established, stable companies |

| Bid- The highest price a buyer is willing to pay. Ask the lowest price a seller is willing to accept. | Long Position- Owning a stock with an expectation of price appreciation. |

| Day Trading-Buying and selling stocks within a single trading day. | Short Selling- Selling borrowed stocks, anticipating price decline. |

| Liquidity- Ease of buying/selling without affecting the price. | Market Maker- Facilitates stock trades by providing liquidity. |

| IPO (Initial Public Offering)- First sale of stock by a company to the public. | Yield- Income earned from an investment, usually in dividends or interest. |

| Blue Sky Laws- State regulations to protect investors. | Cyclical Stocks- Tied to economic cycles, sensitive to economic conditions. |

| Earnings Report- Company’s financial performance statement. | Index Fund- Investment mirroring a specific market index. |

| Mutual Fund- Pooled investment managed by professionals. | Market Timing- Buying/selling based on predicted market movements. |

| Asset Allocation- Distribution of investments among different asset classes. | Stock Split- Division of existing shares to increase liquidity. |

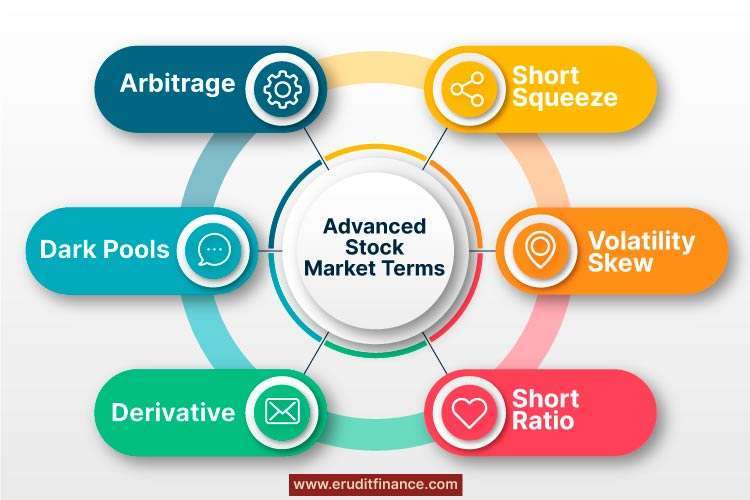

Advanced Stock Market Terms

Here are some advanced stock market terms:

- Algorithmic Trading- Use of algorithms for automated and high-frequency trading.

- Arbitrage– Exploiting price differences of a financial instrument in different markets.

- Market Maker- Entity facilitating trading by providing liquidity.

- Dark Pools- Private forums for trading securities with reduced transparency.

- Derivative- Financial contract deriving its value from an underlying asset.

- Leveraged ETFs- Exchange-Traded Funds that use derivatives to amplify returns.

- High-Frequency Trading (HFT)- Rapid execution of large numbers of orders using algorithms.

- Margin Call- Demand from a broker for additional funds due to a drop in account value.

- Market Sentiment- Overall attitude of investors toward a particular security or the market.

- Quantitative Easing (QE)- Central bank policy to stimulate the economy by buying financial assets.

- Short Squeeze– Rapid price increase forcing short sellers to cover their positions.

- Volatility Skew- Imbalance in implied volatility levels for options with different strike prices.

- Black Swan Event- An unexpected and severe market event with widespread consequences.

- Convertible Bonds- Bonds that can be converted into a company’s stock.

- Pump and Dump- A scheme where the price of a stock is artificially inflated and then sold off.

- Options Greeks- Measures like Delta, Gamma, Theta, and Vega that assess option risks.

- REIT (Real Estate Investment Trust)- Company owning, operating, or financing income-generating real estate.

- Securities Lending- Lending securities to other investors, often for short selling.

- Short Ratio- Ratio of short interest to average daily trading volume.

- Dark Cloud Cover- Bearish candlestick pattern signaling a potential reversal.

- Dead Cat Bounce- Temporary recovery in a declining market, followed by a further decline.

- Efficient Market Hypothesis (EMH)- The theory that prices reflect all available information.

- Green Shoe Option- Provision allowing the sale of additional shares in an IPO.

- Insider Trading- Buying or selling a security based on material non-public information.

- Junk Bond- High-yield, high-risk bonds with lower credit ratings.

- Lock-Up Period- This period after an IPO when insiders are prohibited from selling shares.

- Momentum Investing- Strategy based on the belief that securities in motion will stay in motion.

- Put-Call Ratio- Ratio of put options to call options used to gauge market sentiment.

- Rally- Rapid and sustained increase in the prices of stocks.

- Technical Analysis- Analyzing historical price and volume data to predict future price movements.

- Unicorn- Privately held startup with a valuation exceeding $1 billion.

- Volatility Smile- Options pricing pattern where implied volatility varies with strike price and expiration.

- Wash Trading- Illegitimate practice of buying and selling to create a false impression of market activity.

- X-Dividend Date- The date after which a buyer no longer receives the most recent dividend.

- Yield Curve- Graph showing the relationship between interest rates and the time to maturity of debt.

- Zero-Coupon Bond- Bond issued at a discount, paying no interest but redeemable at face value at maturity.

Broker Vocabulary

Here is a list of broker-related vocabulary.

1). Brokerage Account- An account with a brokerage firm allowing investors to buy and sell securities.

2). Commission- Fee charged by a broker for executing a trade.

3). Margin Account- An account that allows investors to borrow money to buy securities.

4) Day Trading- Buying and selling securities within the same trading day.

5). Market Order- An order to buy or sell a security at the current market price.

6). Limit Order- An order to buy or sell a security at a specific price or better.

7). Stop Order- An order to buy or sell a security once it reaches a certain price, triggering market orders.

8). Fill or Kill (FOK)- An order that must be executed immediately or canceled.

9). Good ’til Cancelled (GTC)- An order to buy or sell a security that remains active until it’s either executed or canceled.

10). Securities Exchange Commission (SEC)- U.S. regulatory agency overseeing securities markets.

11). Financial Industry Regulatory Authority (FINRA)- Regulatory body that oversees brokerage firms and their registered representatives.

12). Clearing House- An intermediary that facilitates the settlement of trades by ensuring delivery of securities and payment.

13). Broker’s Fee- The compensation charged by a broker for their services.

14). Custodian– Entity responsible for holding and safeguarding financial assets on behalf of clients.

15). Registered Representative- An individual associated with a brokerage firm who is authorized to buy and sell securities on behalf of clients.

16). Full-Service Broker- A brokerage firm that offers a wide range of financial services and advice.

17). Discount Broker- A brokerage firm that offers lower commission rates but may provide fewer services.

18). Robo-Advisor- An automated, algorithm-driven platform that provides investment advice & executes trades.

19). Margin Call- A demand by a broker for additional funds to cover potential losses in a margin account.

20). Electronic Communication Network (ECN)- A computerized system facilitating the trading of financial products outside traditional exchanges.

21). Securities Investor Protection Corporation (SIPC)- A nonprofit corporation that provides limited protection to customers in the event of a brokerage firm’s financial failure.

22). Wire Transfer- Electronic transfer of funds between banks.

23). Options Trading- Buying and selling options contracts on the market.

24). Rollover IRA- Moving funds from one retirement account to another without incurring taxes.

25). Dividend Reinvestment Plan (DRIP)- Automatically reinvesting dividends to purchase additional shares.

26). Proxy Statement- Document disclosing information about a company’s management and board.

27). Roth IRA- A retirement account where contributions are made after-tax, & qualified withdrawals are tax-free.

28). Asset Management Account (AMA)- An account combining banking and investment services.

29). Joint Account- An account owned by two or more individuals.

30). Penny Stock- Low-priced, speculative stocks often traded over the counter.

Understanding these terms can help investors navigate the world of brokerage and make informed decisions.

Stock Exchange Vocabulary

Here’s a list of stock exchange-related vocabulary.

| Stock Exchange- A centralized marketplace where buyers and sellers trade stocks and other securities. |

| Listing- The process of a company having its shares traded on a stock exchange. |

| Ticker Symbol- A unique series of letters assigned to a security for trading purposes. |

| Bull Market- A market characterized by rising stock prices and positive investor sentiment. |

| Bear Market- A market characterized by falling stock prices and negative investor sentiment. |

| Market Capitalization (Market Cap)- The total value of a company’s outstanding shares of stock. |

| IPO (Initial Public Offering)- The first sale of a company’s stock to the public. |

| Dividend- A portion of a company’s earnings distributed to shareholders. |

| Brokerage Fee- The fee charged by a broker for executing a trade on behalf of an investor. |

| Floor Trader- A person who executes trades on the floor of a stock exchange. |

| Bid Price- The highest price a buyer is willing to pay for a security. |

| Ask Price- The lowest price a seller is willing to accept for a security. |

| Closing Bell- The signal indicating the end of the trading day on a stock exchange. |

| Market Order- An order to buy or sell a security at the current market price. |

| Volume- The number of shares traded in a specific security or market during a given period. |

| Limit Order- An order to buy or sell a security at a specific price or better. |

| Floor Broker- An individual on the trading floor who executes trades on behalf of clients. |

| Circuit Breaker- Automatic halting of trading on a stock exchange to prevent panic selling or buying. |

| Portfolio- A collection of financial assets owned by an individual or institution. |

| Day Trader- An individual who buys and sells securities within the same trading day. |

Understanding these terms can help individuals navigate the intricacies of the stock exchange and make informed investment decisions.

Stock Market Investment Vocabulary

Here’s a list of stock market investment-related vocabulary:

a). Asset Allocation- The distribution of investments across different asset classes (stocks, bonds, etc.) to manage risk.

b). Diversification- Spreading investments across different securities or asset classes to reduce risk.

c). Portfolio- A collection of investments owned by an individual or institution.

d). Risk Tolerance- An investor’s ability and willingness to withstand the ups and downs of the market.

e). Dividend Yield- The annual dividend income as a percentage of the investment’s current market price.

f). Capital Gains- Profits earned from the sale of an investment at a higher price than the purchase price.

g). Market Order- An order to buy or sell a security at the current market price.

h). Limit Order- An order to buy or sell a security at a specific price or better.

i). Stop-Loss Order- An order to sell a security if its price falls to a specified level, limiting potential losses.

j). Liquidity- The ease with which an asset can be bought or sold without affecting its price.

k). ROI (Return on Investment)- The percentage gain or loss on an investment relative to its cost.

l). ROE (Return on Equity)- A measure of a company’s profitability, calculated as net income divided by shareholders’ equity.

m). P/E Ratio (Price-to-Earnings Ratio)- A valuation ratio calculated as the market price per share divided by earnings per share.

n). Market Cap (Market Capitalization)- The total value of a company’s outstanding shares, calculated by multiplying the share price by the number of shares.

o). ETF (Exchange-Traded Fund)- A type of investment fund and exchange-traded product, representing a basket of assets.

p). Index Fund- A type of mutual fund or ETF that aims to replicate the performance of a specific market index.

q). BETA- A measure of a stock’s volatility about the overall market.

r). Asset Under Management (AUM)- The total market value of assets managed by a financial institution or investment company.

s). Cyclical Stocks– Stocks of companies whose performance is tied to economic cycles.

t). Market Capitalization- The total value of a company’s outstanding shares of stock.

u). Hedging- Using financial instruments to offset the risk of potential losses in other investments.

v). 401(k)- A retirement savings plan offered by employers, often with tax advantages.

w). Dollar-Cost Averaging- An investment strategy where an investor consistently buys a fixed dollar amount of a particular investment over time, regardless of the investment’s price.

x). Bonds- Debt securities that represent loans made by investors to companies or governments.

y). Options- Financial instruments that give the holder the right, but not the obligation, to buy or sell an asset at a predetermined price.

Understanding these terms is essential for investors to make informed decisions and navigate the complexities of the stock market.

Bottomline:-

In essence, for beginners entering the dynamic world of the stock market, it’s crucial to grasp fundamental terms. Stocks symbolize ownership in a company, with the market acting as the platform for buying and selling these ownership shares. A ‘bull market’ signifies optimism with rising prices, while a ‘bear market’ reflects pessimism with falling prices. Understanding ‘market capitalization’ provides insights into a company’s overall value, and ‘dividends’ represent profits distributed to shareholders. The ‘P/E ratio assesses a stock’s valuation, and ‘diversification’ involves spreading investments for risk management. Brokers facilitate trades, ‘IPOs’ mark a company’s debut on the market, and ‘ETFs’ offer diversified investment options. Awareness of these terms forms a solid foundation for navigating the stock market landscape.

Also Read: